A critique of Lindzen & Choi’s 2009 paper has just been published, debunking the notion of strong negative temperature feedback in the tropics. I had noticed that its statistical method of identifying intervals in a time series was flawed, and that models cited appeared to sometimes lack volcanic forcings, rendering correlations meaningless. I’m happy to see those observations confirmed, and a few other problems raised. (I’m happy that I was right, not that climate sensitivity is higher than Lindzen & Choi suggest, which would be good for the planet.) I haven’t read the details of the critiques, so I can’t say whether this really closes the book on the question, but it at least indicates that the original work was a bit sloppy. Since Lindzen is one of the few contrarians who knows what he’s doing, and it’s useful to have such people around, I wish he would focus less on WSJ editorials and more on scholarship.

Month: January 2010

From Beijing to Copenhagen

Check out my guest post at Inside-Out China.

The end is near

There’s really no sense having any kind of long term policy, because the LHC is going to kill us all.

Climate bills LITE

Over Christmas, with little fanfare, two new approaches to climate legislation were introduced, perhaps in response to the possibility that Boxer-Kerry’s prospects are dimming. VentureBeat has a summary. The Kerry-Lieberman-Graham approach is just a “framework” and too vague for me to sink my teeth into. The Cantwell-Collins CLEAR act on the other hand is a real bill. Unlike the 1000-page ACES (Waxman-Markey), it’s just about cap & trade, so it’s refreshingly brief – 39 pages. CLEAR sets targets,

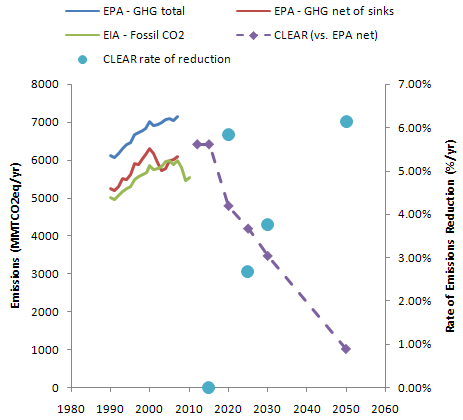

As in Waxman-Markey and other bills, the target trajectory is mostly linear. That actually doesn’t make much sense, because it implies a much greater proportional effort late in the game. Emissions reductions finish at >6%/year. If GDP growth is 3%/year, that implies a final intensity reduction rate of >9%/year, which is fairly delusional. Unlike Waxman-Markey, which is strictly linear, the first three years are flat, then there’s a race to the 2020 target. It’s good to harvest the low-hanging fruit quickly, but the 2015-2020 trajectory seems a little sporty.

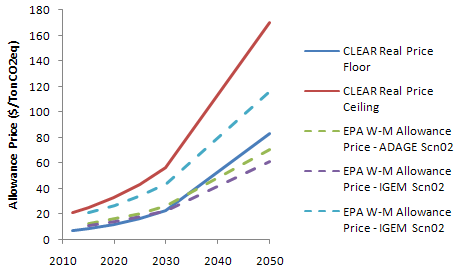

The real emissions trajectory is unknown, because there’s a safety valve price ceiling and floor, initially set at 7 to 21 $/tonCO2eq, and rising at the real interest rate, plus and minus 0.5%, respectively. The resulting prices neatly bracket EPA’s expectations for Waxman-Markey without international offsets (Scn07 on graph):

Source: EPA W-M analysis.

CLEAR is upstream, covering fuels at the minemouth, wellhead, import terminal, etc. This strikes me as a big advantage administratively and improves coverage as well. Offsets, funded by a set-aside from auction revenues, play a much smaller role, which is OK, because with better coverage there won’t be as big a market. International offsets are also assumed to play a much smaller role (a few % of reductions, vs. roughly half of W-M reductions). That makes the true target trajectory much more aggressive, and raises expected permit prices a lot. Whether this is good or bad is ambiguous; one drawback is that there’s potentially less “carrot” for developing countries, and less funding for forestry.

Unlike Waxman-Markey, CLEAR allocates most (75%) permits to citizens as “shares”. That’s bad news for coal-fired electric utilities, but possibly good news for low income residents of coal-intensive areas. My guess is that the totally flat distribution of revenue would more than compensate for regional inequities for the bottom quintile, who would come out ahead. The remaining permits go to a “CERT” fund for worker, business, and community transitions, stranded assets, targeted relief for energy-intensive industries exporting to countries without emissions controls, R&D, offsets and other usual suspects. There’s room for a lot of good here, but also a lot of pork. I think it would make sense to partially phase out the fund in the future, as its revenues would likely rise beyond the need.

Like W-M, CLEAR includes a border adjustment (effectively a tariff on the embodied carbon content of imports). This, plus the potential trade measures in CERT, should make labor happy and infuriate WTO partners like China.

Strategically, CLEAR seems to leave more of the detailed design of the market and related mechanisms to the executive branch. I think that’s a good thing. It’s impossible to have a sensible debate about a piece of legislation the size of the Oxford dictionary. Add in the fact that this proposal is much closer to economic ideals for a cap & trade (upstream coverage, flat rebates, safety valves) and I’m liking this a lot better than ACES.

Climate Panic?

Grist muses over the possibility that abrupt climate change in the not-too-distant future might trigger a chaotic response.

One morning in the not too distant future, you might wake up and walk to your mailbox. The newspaper is in there and it’s covered with shocking headlines: Coal Plants Shut Down! Airline Travel Down 50 Percent! New Federal Carbon Restrictions in Place! Governor Kicked Out of Office for Climate Indolence!

…

It is exactly these economic impacts that the Glenn Becks and the Rush Limbaughs fear we’ll impose on ourselves through restrictive government regulation of energy and carbon emissions. Ironically, a “no action” approach today actually makes a climate panic much more likely over time. What we’re describing would be popularly driven, not fueled by governments or policy wonks. It would be the direct result of free will, democracy, autonomy and the information superhighway. All these forces would accelerate, not mitigate, the greatest “Aha!” moment in the history of the human species. Imagine the sub-prime mortgage bubble pop multiplied a hundred fold.

I hesitate to argue for rationality (certainly our current climate and energy policies aren’t), but I think the physics of climate and human nature do not favor this outcome. The pain of economic dislocation is immediate. At the point of abrupt climate change, on the other hand, it would be evident that we’re stuck with it for decades, because there’s no quick way to reverse the accumulation of GHGs in the atmosphere. Even lowering emissions to zero overnight would have only a gradual climatic effect. Since that would be evident to everyone, especially those with GHG-intensive assets, it seems unlikely that rapid controls would emerge, and likely that they would be reversed when their pain was felt too keenly. I suppose macroeconomic feedbacks might make the damage irreversible, or countries might start launching cruise missiles at each others’ coal-fired power plants, but those seem like long odds.

More likely, I suspect, is that panic would yield enormous pressure to pursue geoengineering options – the only real prospect for a quick reversal of radiative imbalance. If, at that point, we’ve triggered abrupt climate changes without warning, it seems likely that our understanding of geoengineering side-effects would still be half-baked. The nasty side effects that might emerge from efforts under such circumstances strikes me as the greater threat of climate panic.

Setting climate aside, another panic scenario that should concern fossil-fired asset owners is a major oil supply disruption. That could de facto shut down emissions and use through high prices, no political will power required.