Are border carbon adjustments (BCAs) the wave of the future? Consider these two figures:

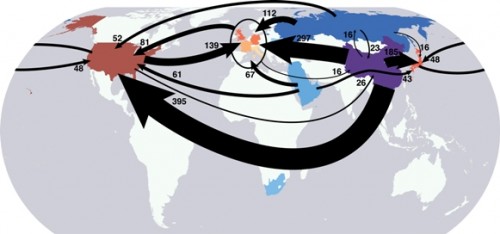

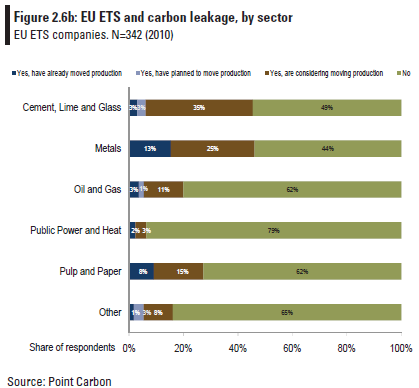

The first shows the scale of carbon embodied in trade. The second, even if it overstates true intentions, demonstrates the threat of carbon outsourcing. Both are compelling arguments for border adjustments (i.e. tariffs) on GHG emissions.

I think things could easily go this route: it’s essentially a noncooperative route to a harmonized global carbon price. Unlike global emissions trading, it’s not driven by any principle of fair allocation of property rights in the atmosphere; instead it serves the more vulgar notion that everyone (or at least every nation) keeps their own money.

Consider the pros and cons:

Advocates of BCAs claim that the measures are intended to address three factors. First, competitiveness concerns where some industries in developed countries consider that a BCA will protect their global competitiveness vis-a-vis industries in countries that do not apply the same requirements. The second argument for BCAs is ‘carbon leakage’ – the notion that emissions might move to countries where rules are less stringent. A third argument, of the highest political relevance, has to do with ‘leveraging’ the participation of developing countries in binding mitigation schemes or to adopt comparable measures to offset emissions by their own industries.

from a developing country perspective, at least three arguments run counter to that idea: 1) that the use of BCAs is a prima facie violation of the spirit and letter of multilateral trade principles and norms that require equal treatment among equal goods; 2) that BCAs are a disguised form of protectionism; and 3) that BCAs undermine in practice the principle of common but differentiated responsibilities.

In other words: the advocates are a strong domestic constituency with material arguments in places where BCAs might arise. The opponents are somewhere else and don’t get to vote, and armed with legalistic principles more than fear and greed.

Tom, how do you view the issue of consumption versus production? Deregulation in countries where production occurs means products are cheaper in the countries where they are consumed, which is probably a nice example of feedback.

Maybe the threat of border adjustments would force the countries where production occurs would make them act, but there’s a definite equity issue here.

I agree that there’s an equity issue. I’m not sure which way it runs though, because it’s tied up with more general trade, exchange rate, and environmental policy. For example, it seems to me that China sticks it to the rural poor by dumping its industrial pollution on them, while restraining their mobility to the cities where they might get some benefit from manufacturing cheap goods for the US. A US carbon tariff might actually have some benefits for the poorest, even setting aside its climate mitigation effect.