If a global oil shock reduces supply 10%, the price of crude will rise to $20,000/barrel, with fuel expenditures consuming more than the entire GDP of importing nations.

At least that’s what you’d predict if you think the price elasticity of oil demand is about -0.02. I saw that number in a Breakthrough post, citing Kevin Drum, citing Early Warning, citing IMF. It’s puzzling that Breakthrough is plugging small price elasticities here, when their other arguments about the rebound effect require elasticities to have large magnitudes.

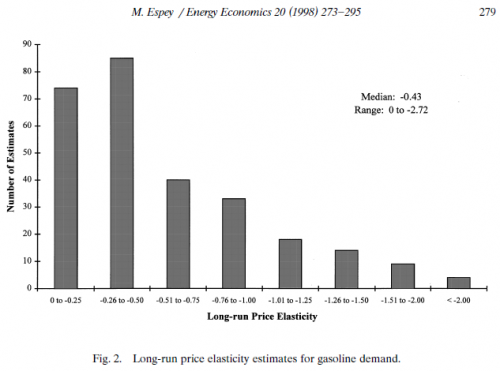

There’s no doubt that short run elasticities are small, though the IMF figures are over-the-top small (-0.007 in non-OECD countries). What caught my attention, though, was the assertion that long run elasticities are also small – smaller than -0.1 in IMF’s table 3.1, for example.

I’ve never run across an energy model with such minimalist long run elasticities. Nor have I seen statistical estimates that low. So, I dug a little deeper.

It turns out that meta-analyses do catalog statistical estimates of long-run elasticity of gasoline and transport fuel demand as small as zero. (I can’t fathom how anyone could report such a figure with a straight face, given the thought experiment at top.) However, near-zero results are far from the means of such surveys. Adam Ozimek at Modeled Behavior examines some of the reasons to be cautious of small elasticities rather well.

To that list, I’d add my guess, that small elasticity estimates are biased by omission of feedback and attendant consideration of measurement error in many studies. Estimates I’ve seen that have a fairly strong treatment of dynamics by econometric standards are weak by dynamic modeling standards. This may explain why no one builds energy models with a long run elasticity of -0.1: such values just aren’t plausible in a full-feedback context.

A related problem is that the “long term” in estimates is often rather short. The IMF estimate, for example, uses data from 1990-2009. That’s only a little longer than one lifetime of a vehicle, and the “interesting” part, with real variation in oil prices, is much shorter than that – not long enough to turn over even half the vehicle fleet. By contrast, the time constants for urban development patterns and lifetimes of transportation infrastructure are much longer – on the order of 50 years. Indeed, when the IMF uses a longer sample (table 3.3), the estimated long-run price elasticity for the OECD is six times larger.

Yet another issue is that elasticities are typically estimated via an equation like quantity = price^epsilon, where epsilon is the elasticity. The price is normally interpreted as the price of energy, but the cost a consumer faces is typically (price + indirect costs), where the indirect costs are associated with energy use but not observed. So, one ought to estimate quantity = (price+cost)^sigma (if one could observe cost). In this case, the local elasticity is diluted by the cost, but as price (or taxes) rise, the observed elasticity approaches sigma, which is greater than epsilon.

Now, here’s the real puzzle. Elsewhere, Breakthrough writers are big fans of the rebound effect. REALLY BIG. I’ve never seen it mentioned so often and fervently anywhere else. The idea that efficiency won’t help much to reduce emissions, due to rebound effects, is one of the legs of their argument for an R&D-led climate strategy. The problem is, for rebound effects to matter, price elasticity has to be big. For example, from a lengthy page on the rebound effect,

… in rough terms, if energy efficiency drives down the price of energy services by 30% or 50%, then energy prices would have to increase through carbon taxes or fees by an equivalent 30% or 50%.

That statement implies an elasticity of -1.0, ten to fifty times bigger than the IMF findings. To care about rebound dilution of efficiency gains at all you’d have to think that elasticities were at least -.2 or -.3, so that rebound offset 20 to 30% of efficiency-induced emissions reductions. To believe in Jevon’s paradox, where efficiency improvements increase energy use (>100% rebound), you must believe that elasticities are -1.0 or larger in magnitude.

Breakthrough also argues,

Q: Should we expect rebounds to be the same in rich and poor nations?

A: No, rebound effects are almost certainly larger in poorer, developing nations.

This is exactly the opposite of the IMF report’s finding, that elasticities are much smaller in the non-OECD world, implying trivial rebound effects in developing countries.

So, Breakthrough, which is it? Do gasoline taxes have minimal effects on behavior because price elasticity is small? Or are efficiency measures offset by rebound effects, because price elasticity is large? They can’t both be true.

Who was it that said, “the primary characteristic of a truly enlightened mind is its ability to entertain two seemingly contradictory ideas at the same time?” That’s fine for philosophy, but for policy, I prefer Jay Forrester: “if you have a model, you’ll be the only person in the room who can stand up and talk for 20 minutes without contradicting himself.” Breakthrough clearly needs a model.

FAQ: Rebound Effects and the “Energy Emergence” Report

This set of frequently asked questions accompanies a new Breakthrough Institute report, “Energy Emergence: Rebound and Backfire as Emergent Phenomena.” That report surveys the relevant academic literature and finds extensive evidence that a large amount of the energy savings from below-cost energy efficiency are eroded by demand ‘rebound effects.’

“Energy Emergence: Rebound and Backfire as Emergent Phenomena” explains why energy efficiency measures that truly ‘pay for themselves’ will lower the cost of energy services — heating, transportation, industrial processes, etc. — driving a rebound in energy demand that can erode a significant portion of the expected energy savings and climate benefits of these measures. This new set of Frequently Asked Questions explains rebound effects, how they operate, what kinds of energy efficiency improvements trigger bigger or smaller rebounds, and why coming to terms with the full scale of rebound challenges the heart of many contemporary climate mitigation strategies. You can download the full “Energy Emergence” report here, or download and view a Power Point briefing on the report here. Click any question below to view the answer… Q: So do rebound effects wipe out all of the energy savings from efficiency improvements? Q: So what’s the big deal? We still make progress right? Why do rebound effects matter? A: In rich, developed nations, if we improve the efficiency of end-use consumer energy services, like cars, home heating and cooling, or appliances, the literature indicates that direct rebound effects alone are typically on the scale of 10-30% of the initial energy savings. Additional indirect and macroeconomic effects may mean total rebound erodes roughly one quarter to one third of expected energy savings in these situations.Rebound here is smallest in cases when demand for the energy service in question is already saturated (that is, we use as much of it as we would care to use), and highest in cases where the cost of the energy service is a key constraint on fulfilling demand for that service. For example, if a wealthy homeowner already reliably heats all the rooms in his or her house to 70 degrees, he/she wouldn’t increase the thermostat to 77 degrees just because our heating system got 10% more efficient. But if a poorer household can’t afford to turn the thermostat up, or only heats one room of the house with a small space heater, because the house is too drafty, then if the house gets weatherized and more efficient, that household is likely to use more energy to heat their home. In general, end-use consumer efficiency improvements in rich, developed economies will still lead to a net savings in energy, although rebound effects shouldn’t be ignored even here.

Q: Should we expect rebounds to be the same in rich and poor nations? A: No, rebound effects are almost certainly larger in poorer, developing nations.

|

I loved your incisive analysis. The Forrester quote is great. My response is a bit more radical though. I think one of the greatest values of a model is that it can bring you to the point where you say “There isn’t any way to build a model within this methodology that is not self-contradicting. Therefore everyone in this room is contradicting themselves before they even open their mouths.” 🙂 I even made a video on the subject.. http://www.youtube.com/watch?v=E8hlogQMyNs

cheers!

Miles