Breakthrough’s Nordhaus and Shellenberger (N&S) spot a bit of open-loop thinking about LED lighting:

ON Tuesday, the Royal Swedish Academy of Sciences awarded the 2014 Nobel Prize in Physics to three researchers whose work contributed to the development of a radically more efficient form of lighting known as light-emitting diodes, or LEDs.

In announcing the award, the academy said, “Replacing light bulbs and fluorescent tubes with LEDs will lead to a drastic reduction of electricity requirements for lighting.” The president of the Institute of Physics noted: “With 20 percent of the world’s electricity used for lighting, it’s been calculated that optimal use of LED lighting could reduce this to 4 percent.”

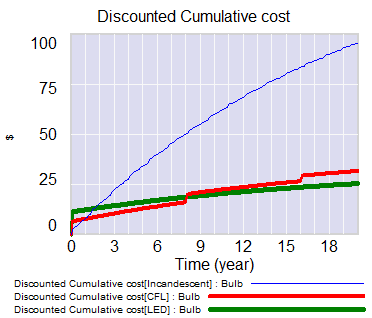

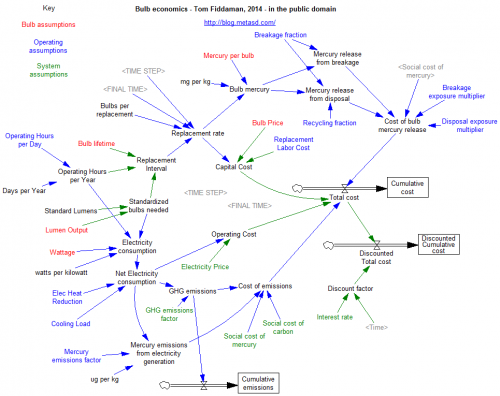

The problem of course is that lighting energy use would fall 20% to 4% only if there’s no feedback, so that LEDs replace incandescents 1 for 1 (and of course the multiplier can’t be that big, because CFLs and other efficient technologies already supply a lot of light).

N&S go on to argue:

But it would be a mistake to assume that LEDs will significantly reduce overall energy consumption.

Why? Because rebound effects will eat up the efficiency gains:

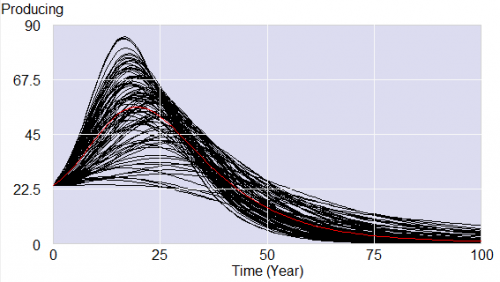

“The growing evidence that low-cost efficiency often leads to faster energy growth was recently considered by both the Intergovernmental Panel on Climate Change and the International Energy Agency.”

“The I.E.A. and I.P.C.C. estimate that the rebound could be over 50 percent globally.”

Notice the sleight-of-hand: the first statement implies a rebound effect greater than 100%, while the evidence they’re citing describes a rebound of 50%, i.e. 50% of the efficiency gain is preserved, which seems pretty significant.

Presumably the real evidence they have in mind is http://iopscience.iop.org/0022-3727/43/35/354001 – authors Tsao & Saunders are Breakthrough associates. Saunders describes a 100% rebound for lighting here http://thebreakthrough.org/index.php/programs/energy-and-climate/understanding-energy-efficiency-rebound-interview-with-harry-saunders

Now the big non sequitur:

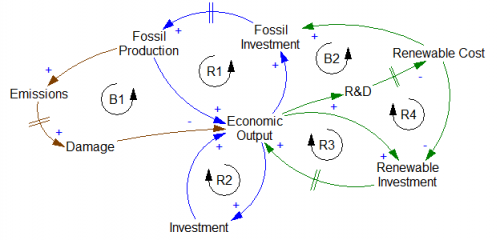

But LED and other ultraefficient lighting technologies are unlikely to reduce global energy consumption or reduce carbon emissions. If we are to make a serious dent in carbon emissions, there is no escaping the need to shift to cleaner sources of energy.

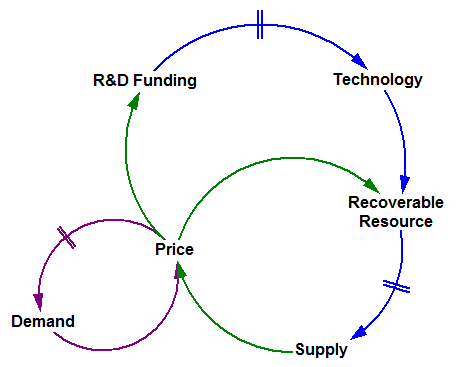

Let’s assume the premise is true – that the lighting rebound effect is 100% or more. That implies that lighting use is highly price elastic, which in turn means that an emissions price like a carbon tax will have a strong influence on lighting energy. Therefore pricing can play a major role in reducing emissions. It’s probably still true that a shift to clean energy is unavoidable, but it’s not an exclusive remedy, and a stronger rebound effect actually weakens the argument for clean sources.

Their own colleagues point this out:

In fact, our paper shows that, for the two 2030 scenarios (with and without solid-state lighting), a mere 12% increase in real electricity prices would result in a net decline in electricity-for-lighting consumption.

What should the real takeaway be?

- Subsidizing lighting efficiency is ineffective, and possibly even counterproductive.

- Subsidizing clean energy lowers the cost of delivering lighting and other services, and therefore will also be offset by rebound effects.

- Emissions pricing is a win-win, because it encourages efficiency, counteracts rebound effects and promotes substitution of clean sources.