I just created an annotated list of links on learning/experience curves, deliberate R&D, and other forms of endogenous energy technology, including a few models and empirical estimates. See del.icio.us/tomfid for details. Comments with more references will be greatly appreciated!

Category: energy

Backing Off on Ethanol

ST. PAUL (Reuters) –

U.S. Republicans called on Monday for an end to a controversial requirement that gasoline contain a set amount of ethanol, a policy backed by the Bush administration that critics say has helped drive up world food prices.

In their 2008 platform detailing policy positions, Republicans said markets — not government — should determine how much ethanol is blended into gasoline, and pushed for development of a cellulosic version, which could be made from grasses rather than corn.

It will be interesting to see what this implies for California’s LCFS design.

Update

Corn belt Republicans are not pleased.

Contrast the new platform with the situation in 2005.

McCain seems to have done a double-flip-flop, reversing his 2006 reversal of his 2000 campaign position: Continue reading “Backing Off on Ethanol”

China's Energy Policy Comes at a Price

That’s the title of a letter in the latest edition of Science. It nicely expands on some of my earlier concerns about China’s energy policy in the Clout & Climate Change war game and in reality. The author, Quiang Wang of the Guangzhou Institute of Geochemistry, writes,

…

China’s energy prices are mainly decided and controlled by the government. Because the government emphasizes social stability over scarcity of resources or environmental cost, it sets the energy prices very low. For example, Chinese gasoline and diesel prices rose by less than 10% in 2007, when global oil price nearly doubled. Moreover, in January 2008, the Chinese government decided to freeze energy prices in the near term, even as international crude oil futures have continued to surge.

Energy conservation and efficiency are hard to achieve because government-set prices encourage excessive energy consumption and waste. The low energy prices send a distorted market signal to consumers that there is no shortage of natural resources, indicating that enhancing energy efficiency is unnecessary and waste is justified.

…

A market-oriented energy-pricing mechanism is an inevitable requirement for China to address climate change, although the reform of the energy pricing mechanism means increased energy prices, which will bring public dissatisfaction and possibly social instability.

In 2005, I built a simple model of the Chinese electric power system, focused on coal-fired generation. One of the most beneficial strategies in the model is to make plant dispatch and power pricing more market-oriented, strengthening the incentive to install cleaner generation and retire or retrofit old dirties. That’s tough to implement as long as utilities wield more power than their regulators.

Regional Climate Initiatives – Model Roll Call – Part II

Minnesota

The Minnesota Next Generation Energy Act establishes a goal of reducing GHG emissions by 15% by 2015, 30% by 2025, and 80% by 2050, relative to 2005 levels.

From ScienceDaily comes news of a new research report from University of Minnesota’s Center fro Transportation Studies. The study looks at options for reducing transport emissions. Interestingly, transport represents 24% of MN emissions, vs. more than 40% in CA. The study decomposes emissions according to a variant of the IPAT identity,

Emissions = (Fuel/VehicleMile) x (Carbon/Fuel) x (VehicleMilesTraveled)

Vehicle and fuel effects are then modeled with LEAP, an energy modeling platform with a fast-growing following. The VMT portion is tackled with a spreadsheet calculator from CCAP’s Guidebook. I haven’t had much time to examine the latter, but it considers a rich set of options and looks like at least a useful repository of data. However, it’s a static framework, and land use-transportation interactions are highly dynamic. I’d expect it to be a useful way to construct alternative transport system visions, but not much help determining how to get there from here.

Minnesota’s Climate Change Advisory Group TWG on land use and transportation has a draft inventory and forecast of emissions. The Energy Supply and Residential/Commercial/Industrial TWGs developed spreadsheet analyses of a number of options. Analysis and Assumptions memos describe the results, but the spreadsheets are not online.

British Columbia

OK, it’s not a US region, but maybe we could trade it for North Dakota. BC has a revenue-neutral carbon tax, supplemented by a number of other initiatives. The tax starts at $10/TonCO2 and rises $5/year to $30 by 2012. The tax is offset by low-income tax credits and 2 to 5% reductions in lower income tax brackets; business tax reductions match personal tax reductions in roughly a 1:2 ratio.

BC’s Climate Action Plan includes a quantitative analysis of proposed policies, based on the CIMS model. CIMS is a detailed energy model coupled to a macroeconomic module that generates energy service demands. CIMS sounds a lot like DOE’s NEMS, which means that it could be useful for determining near-term effects of policies with some detail. However, it’s probably way too big to modify quickly to try out-of-the-box ideas, estimate parameters by calibration against history, or perform Monte Carlo simulations to appreciate the uncertainty around an answer.

The BC tax demonstrates a huge advantage of a carbon tax over cap & trade: it can be implemented quickly. The tax was introduced in the Feb. 19 budget, and switched on July 1st. By contrast, the WCI and California cap & trade systems have been underway much longer, and still are no where near going live. The EU ETS was authorized in 2003, turned on in 2005, and still isn’t dialed in (plus it has narrower sector coverage). Why so fast? It’s simple – there’s no trading infrastructure to design, no price uncertainty to worry about, and no wrangling over allowance allocations (though the flip side of the last point is that there’s also no transient compensation for carbon-intensive industries).

Bizarrely, BC wants to mess everything up by layering cap & trade on top of the carbon tax, coordinated with the WCI (in which BC is a partner).

Drilling in America

I don’t usually have TV, but I’m in a hotel tonight. I just saw a McCain ad that would be funny if it weren’t serious. It starts with some blather about high gas prices, and a picture of an old pump (designed to trigger nostalgia for 25 cents a gallon?). It goes on to imply that domestic drilling is the oil security answer. Then it makes the really amazing assertion (“you know who’s to blame”) that the only thing standing in the way of domestic drilling is … Obama. Wow … I had no idea that one senator could single-handedly wield such power.

Transportation Developments

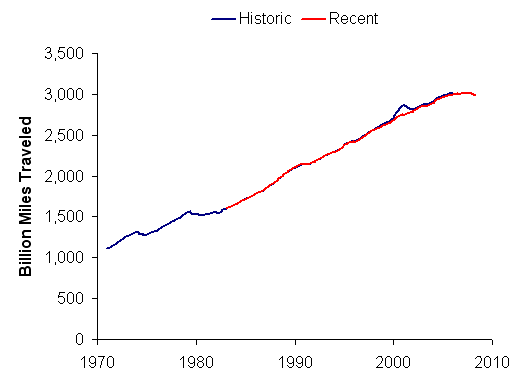

GreenCarCongress has some interesting tidbits of recent data: vehicle miles traveled is down and sales of cars surpass trucks, reversing long run trends. An interesting side effect of diminished driving and fuel use is that less money goes into the federal Highway Trust Fund. Because a small portion funds transit, this pulls the rug out from under alternative modes just when they’re needed. I immediately wondered whether the recent falloff in VMT is similar to what happened around the 1973 and 1979 oil price spikes. DOT’s Traffic Volume Trends data provides the answer, if you add historic archive data to recent reports:

More Oil Price Forecasts

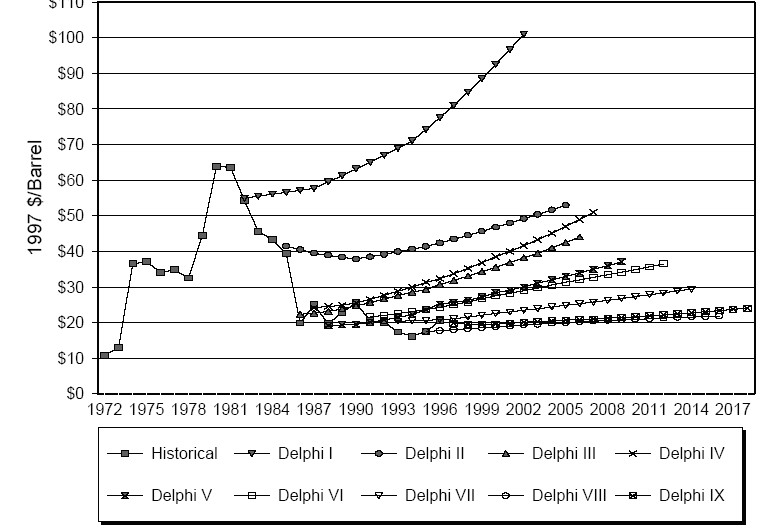

The history of long term energy forecasting is a rather mixed bag. Supply and demand forecasts have generally been half decent, in terms of percent error, but that’s primarily because GDP growth is steady, energy intensity is price-inelastic, and there’s a lot of momentum in energy consuming and producing capital. Energy price forecasts, on the other hand, have generally been terrible. Consider the Delphi panel forecasts conducted by the CEC:

In 1988, John Sterman showed that energy forecasts, even those using sophisticated models, were well represented by a simple adaptive rule: Continue reading “More Oil Price Forecasts”

No Gas

Every year or two the “gas out” email arrives in my inbox. This year, it’s May 15th when “all internet users are to not go to a gas station in protest of high gas prices.” Wait – am I supposed to avoid gas stations, or protesting at gas stations? I’m amazed at the durability of this internet chain letter, which now claims a ten-year history: “In April 1997, there was a “gas out” conducted nationwide in protest of gas prices. Gasoline prices dropped 30 cents a gallon overnight.” A Monty Python tune from The Meaning of Life jumps to mind:

So remember when you’re feeling very small and insecure

How amazingly unlikely is your birth

And pray that there’s intelligent life somewhere up in space

Because there’s bugger all down here on earth.

The Switch to Small Cars – Not So Fast

The NYT reports that a switch to efficient cars is underway, as evidenced by, among other things, an increase in market share for small cars from an eighth of the market at the height of SUV-mania to a fifth today, together with a sharp drop in large truck and SUV sales.

If sustained, such a shift would signal a very significant sensitivity of vehicle efficiency purchasing habits to fuel prices – perhaps much larger than the low short run price elasticity of gasoline demand. However, I think there is reason to interpret these recent events cautiously, lest they prove a little less astonishing in the long run. Continue reading “The Switch to Small Cars – Not So Fast”

It's the crude price, stupid

The NYT reports that Hillary Clinton and John McCain have lined up to suspend federal excise taxes on fuel:

Senator Hillary Rodham Clinton lined up with Senator John McCain, the presumptive Republican nominee for president, in endorsing a plan to suspend the federal excise tax on gasoline, 18.4 cents a gallon, for the summer travel season. But Senator Barack Obama, Mrs. Clinton’s Democratic rival, spoke out firmly against the proposal, saying it would save consumers little and do nothing to curtail oil consumption and imports.

…

Mrs. Clinton would replace that money with the new tax on oil company profits, an idea that has been kicking around Congress for several years but has not been enacted into law. Mr. McCain would divert tax revenue from other sources to make the highway trust fund whole.

On April 22, EIA data put WTI crude at $119/bbl, which is $2.83/gal before accounting for refinery losses. Spot gasoline was at $2.90 to $3.14 (depending on geography and type), which is about what you’d expect with total taxes near $0.50 and retail gasoline at $3.55/gal. With refinery yields typically at something like 85%, you’d actually expect spot gasoline to be at about $3.30, so other, more-expensive products (diesel, jet fuel, heating oil) or cheaper feedstocks must be making up the difference. The price breaks down roughly as follows: