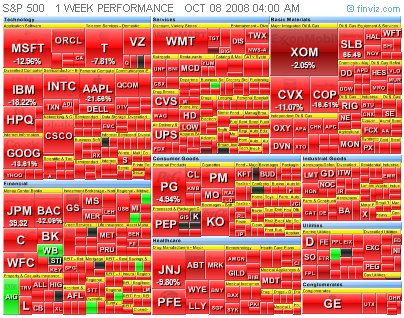

Things are bouncing back this morning, but it’s been an ugly week. The broad market is a sea of red:

This is a treemap visualization of market movements, courtesy of FinViz.

Peak oil gets all the attention, but the peak isn’t the problem. Unless your assumptions about the dynamics of oil production are rather artificial, there will be an inflection point before the peak. Symptoms of strain in the system appear as soon as the production rate grows more slowly more slowly than GDP less intensity improvements, or simply more slowly than expected. That’s when price has to begin rising to clear the market, creating the signal to alternatives (efficiency, biofuels, unconventional oil …) that they are needed, so that’s when the pain hits. Whether the pain is brief and results in an orderly transition, or something rockier, is a matter for some debate. Either way, arguing about when the peak might come is the wrong question; we should be considering whether we’re past the inflection point, and thus in a period of rising stress, and what to do about it.

Production and Operations Management 17(4) honors Jay Forrester as an important person in the history of operations management. He joins Kenneth Arrow, Ronald Coase, and William Cooper in the distinction this year. Congratulations Jay!

Hat tip to John Sterman on the SD email list. I don’t have fulltext access to the journal, but if someone sends me a snippet, I’ll post it.

MetaRoundup:

Several of the economics blogs I read have had useful roundups of bailout commentary. A few I find found useful:

Do we need to act now? on Economist’s View

9/26 Links on Economist’s View

NYT Economix’ analyst roundup

Greg Mankiw’s roundup of commentary

Update 9/29:

Real Time Economics’ Secondary Sources

Update 10/1:Â

Greg Mankiw with more commentary

Alternative Plans:

Economists Against the Paulson Plan

Brad de Long on Krugman on the Dodd plan

WSJ Real Time Economics’ Text of Lawmakers’ Agreement on Principles

Thomas Palley on Saving the Financial System

Marginal Revolution on the Republican plan to rescue mortgages instead of buying mortgage assets

Marginal Revolution with a Modest Proposal (finding and isolating toxic assets)

Update 9/27:

Marginal Revolution with substitute bridges

Greg Mankiw with a letter from Robert Shimer with a nice analysis, including problems with Paulson, the lemons problem, and the Diamond, Kaplan, Kashyap, Rajan & Thaler fix

Update 9/28:

Real Time Economics on securitization

Brad deLong on nationalization (the Swedish model)

Update 9/29:

The Big Picture with Stop Targeting Asset Prices

Marginal Revolution asks, is the Sweden plan better?

From the ArXiv blog: researchers have discovered a new fractal, closely matching a Sierpinski Carpet, in the boundary layer dynamics of coffee in milk. I don’t know how Rayleigh-Taylor instabilities work, but I do find occasional cool things in my coffee:

Yesterday the WCI announced its design recommendations.

Update 9/26: WorldChanging has another take on the WCI here.

I haven’t read the whole thing, but here’s my initial impression based on the executive summary:

Scope

Major gases, including CO2, methane, nitrous oxide, hydrofluorocarbons, perfluorocarbons and sulfur hexafluoride.

| What? | In scope? | How/where? |

| Large Industrial & Commercial, >25,000 MTCO2eq/yr | ||

|

Combustion Emissions |

Yes | Point of emission |

|

Process Emissions |

Yes | Point of emission |

| Electricity | Yes | “First Jurisdictional Deliverer” – includes power generated outside WCI |

| Small Industrial, Commercial, Residential | Second Compliance Period (2015-2017) | Upstream (“where fuels enter commerce in the WCI Partner jurisdictions, generally at a distributor. The precise point is TBD and may vary by jurisdiction”) |

| Transportation | ||

|

Gasoline & Diesel |

Second Compliance Period (2015-2017) | Upstream (“where fuels enter commerce in the WCI Partner jurisdictions, generally at a terminal rack, final blender, or distributor. The precise point is TBD and may vary by jurisdiction”) |

|

Biofuel combustion |

No | |

| Biofuel & fossil fuel upstream | To be determined | ? |

| Biomass combustion | No, if determined to be carbon neutral | |

| Agriculture & Forestry | No | |

(See an earlier Midwestern Accord matrix here.)

The NYT has the draft text and an explanation of the Bush administration’s $700 billion bailout proposal. It audaciously creates a budget authority almost as big as the federal government’s total discretionary spending and bigger than every on-budget agency, seven times the California state budget, without any checks and balances at all:

Sec. 8. Review.

Decisions by the Secretary pursuant to the authority of this Act are non-reviewable and committed to agency discretion, and may not be reviewed by any court of law or any administrative agency.

We used to dump tea in harbors for things like this.

ST. PAUL (Reuters) –

U.S. Republicans called on Monday for an end to a controversial requirement that gasoline contain a set amount of ethanol, a policy backed by the Bush administration that critics say has helped drive up world food prices.

In their 2008 platform detailing policy positions, Republicans said markets — not government — should determine how much ethanol is blended into gasoline, and pushed for development of a cellulosic version, which could be made from grasses rather than corn.

It will be interesting to see what this implies for California’s LCFS design.

Update

Corn belt Republicans are not pleased.

Contrast the new platform with the situation in 2005.

McCain seems to have done a double-flip-flop, reversing his 2006 reversal of his 2000 campaign position: Continue reading “Backing Off on Ethanol”

Nature News and Climate Feedback report that cooling of sea surface temperatures ca. 1945 is an artifact of changes in measurement technology. ClimateAudit claims priority. Lucia comments.

Will this – like the satellite temperature trend – be another case of model-data discrepancies resolved in favor of the models?

Update: Prometheus wonders if this changes IPCC conclusions.

A pair of papers in Science this week refines the understanding of the acceleration of glacier flow from lubrication by meltwater. The bottom line:

Now a two-pronged study–both broader and more focused than the one that sounded the alarm–has confirmed that meltwater reaches the ice sheet’s base and does indeed speed the ice’s seaward flow. The good news is that the process is more leisurely than many climate scientists had feared. “Is it, ‘Run for the hills, the ice sheet is falling in the ocean’?” asks glaciologist Richard Alley of Pennsylvania State University in State College. “No. It matters, but it’s not huge.” The finding should ease concerns that Greenland ice could raise sea level a disastrous meter or more by the end of the century. Experts remain concerned, however, because meltwater doesn’t explain why Greenland’s rivers of ice have recently surged forward.

A remarkable excerpt:

The meltwater monitoring caught a 4-kilometer-long, 8-meter-deep lake disappearing into the ice in an hour and a half. As theorists had supposed, once the lake water was deep enough, its weight began to wedge open existing cracks, which only increased the weight of overlying water on the crack tip and accelerated cracking downward. Once the main crack reached the bottom of the ice, heat from churning water flow melted out parts of the fracture, and drainage took off. The lake disappeared in about 1.4 hours at an average rate of 8700 cubic meters per second, exceeding the average flow over Niagara Falls. That’s almost four Olympic pools a second.

Check it out (subscription required).