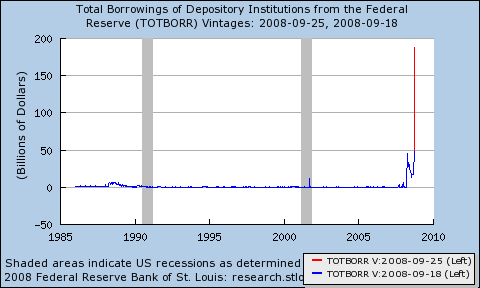

I got a silly chain email, which proposed taking the $85 billion needed for the AIG bailout and distributing it among all 200 million taxpayers, so that we’d each get $425,000 to play with. I decided to test this idea on my boys, who are seven and eight. Ignoring the fact that $85B divided by 200M is $425, not $425,000, we had a conversation about what would happen if the government distributed half a million in cash to every American:

Kid1: That would be generous.

Kid2: That would be hard. There are like 150,000 people just in Bozeman.

Me: Where would the government get that kind of money?

Kid1: Make it (by printing).

Kid2: Steal it from another country.