The official discussion draft of the Kerry-Lieberman American Power Act is out. My heart sank when I saw the page count – 987. I won’t be able to review this in any detail soon. Based on a quick look, I see two potentially huge items: the “hard price collar” has a soft ceiling, and transport fuels are in the market, despite claims to the contrary.

Hard is soft

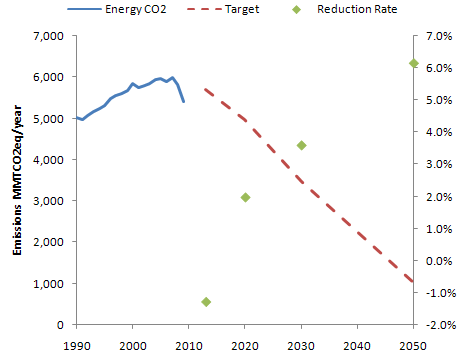

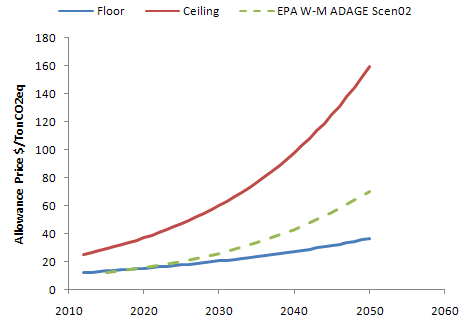

First, the summary states that there’s a “hard price collar which binds carbon prices and creates a predictable system for carbon prices to rise at a fixed rate over inflation.” That’s not quite right. There is indeed a floor, set by an auction reserve price in Section 790. However, I can’t find a ceiling as such. Instead, Section 726 establishes a “Cost Containment Reserve” that is somewhat like the Waxman-Markey strategic reserve, without the roach motel moving average price (offsets check in, but they don’t check out). Instead, reserve allowances are available at the escalating ceiling price ($25 + 5%/yr). There’s a much larger initial reserve (4 gigatons) and I think a more generous topping off (1.5% of allowances each year initially; 5% after 2030). However, there appears to be no mechanism to provide allowances beyond the set-aside. That means that the economy-wide target is in fact binding. If demand eats up the reserve allowance buffer, prices will have to rise above the ceiling in order to clear the market. So, the market actually faces a hard target, with the reserve/ceiling mechanism merely creating a temporary respite from price spikes. The price ceiling is soft if allowance demand at the ceiling price is sufficient to exhaust the buffer. The mental model behind this design must be that estimated future emission prices are about right, so that one need only protect against short term volatility. However, if those estimates are systematically wrong, and the marginal cost of mitigation persistently exceeds the ceiling, the reserve provides no protection against price escalation.

Transport is in the market

The short transport summary asserts:

Since a robust domestic refining industry is critical to our national security, we needed to make a change. We took fuel providers out of the market. Instead of every refinery participating in the market for allowances, we made sure the price of carbon was constant across the industry. That means all fuel providers see the same price of carbon in a given quarter. The system is simple. First, the EPA and EIA Administrators look to historic product sales to estimate how many allowances will be necessary to cover emissions for the quarter, and they set that number of allowances aside at the market price. Then refineries and fuel providers sell fuel, competing as they have always done to offer the best product at the best price. Finally, at the end of the quarter, the refiners and fuel providers purchase the allowances that have been set aside for them. If there are too many or too few allowances set aside, that difference is made up by adjusting the projection for the following quarter. These allowances cannot be banked or traded, and can only be used for compliance purposes.

In fact, transport is in the market, just via a different mechanism. Instead of buying allowances realtime, with banking and borrowing, refiners are price takers and get allowances via a set-aside mechanism. Since there’s nothing about the mechanism that creates allowances, the market still has to clear. The mechanism simply introduces a one quarter delay into the market clearing process. I don’t see how this additional complication is any better for refiners. Introducing the delay into the negative feedback loops that clear the market could be destabilizing. This is so enticing, I’ll have to simulate it.

My analysis is a bit hasty here, so I could be wrong, but if I’m right these two issues have huge implications for the performance of the bill.