Grist muses over the possibility that abrupt climate change in the not-too-distant future might trigger a chaotic response.

One morning in the not too distant future, you might wake up and walk to your mailbox. The newspaper is in there and it’s covered with shocking headlines: Coal Plants Shut Down! Airline Travel Down 50 Percent! New Federal Carbon Restrictions in Place! Governor Kicked Out of Office for Climate Indolence!

…

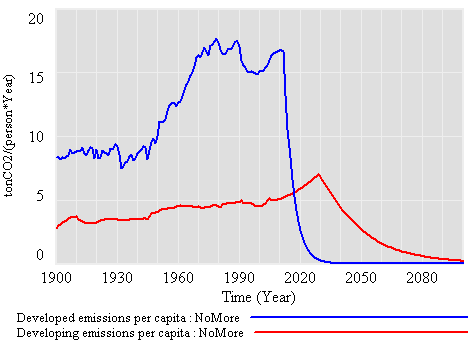

It is exactly these economic impacts that the Glenn Becks and the Rush Limbaughs fear we’ll impose on ourselves through restrictive government regulation of energy and carbon emissions. Ironically, a “no action” approach today actually makes a climate panic much more likely over time. What we’re describing would be popularly driven, not fueled by governments or policy wonks. It would be the direct result of free will, democracy, autonomy and the information superhighway. All these forces would accelerate, not mitigate, the greatest “Aha!” moment in the history of the human species. Imagine the sub-prime mortgage bubble pop multiplied a hundred fold.

I hesitate to argue for rationality (certainly our current climate and energy policies aren’t), but I think the physics of climate and human nature do not favor this outcome. The pain of economic dislocation is immediate. At the point of abrupt climate change, on the other hand, it would be evident that we’re stuck with it for decades, because there’s no quick way to reverse the accumulation of GHGs in the atmosphere. Even lowering emissions to zero overnight would have only a gradual climatic effect. Since that would be evident to everyone, especially those with GHG-intensive assets, it seems unlikely that rapid controls would emerge, and likely that they would be reversed when their pain was felt too keenly. I suppose macroeconomic feedbacks might make the damage irreversible, or countries might start launching cruise missiles at each others’ coal-fired power plants, but those seem like long odds.

More likely, I suspect, is that panic would yield enormous pressure to pursue geoengineering options – the only real prospect for a quick reversal of radiative imbalance. If, at that point, we’ve triggered abrupt climate changes without warning, it seems likely that our understanding of geoengineering side-effects would still be half-baked. The nasty side effects that might emerge from efforts under such circumstances strikes me as the greater threat of climate panic.

Setting climate aside, another panic scenario that should concern fossil-fired asset owners is a major oil supply disruption. That could de facto shut down emissions and use through high prices, no political will power required.