Found this bit, under the headline Carbon Dioxide Levels Rising Despite Economic Downturn:

A leading scientist said on Thursday that atmospheric levels of carbon dioxide are hitting new highs, providing no indication that the world economic downturn is curbing industrial emissions, Reuters reported.

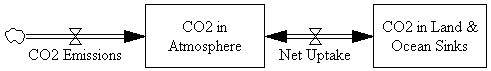

Joe Romm does a good job explaining why conflating emissions with concentrations is a mistake. I’ll just add the visual:

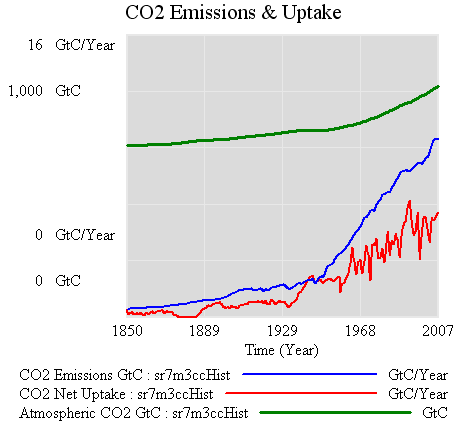

And the data to go with it:

It would indeed take quite a downturn to bring the blue (emissions) below the red (uptake), which is what would have to happen to see a dip in the CO2 atmospheric content (green). In fact, the problem is tougher than it looks, because a fall in emissions would be accompanied by a fall in net uptake, due to the behavior of short-term sinks. Notice that atmospheric CO2 kept going up after the 1929 crash. (Interestingly, it levels off from about 1940-1945, but it’s hard to attribute that because it appears to be within natural variability).

At the moment, it’s kind of odd to look for the downturn in the atmosphere when you can observe fossil fuel consumption directly. The official stats do involve some lag, but less than waiting for natural variability to shake out of sparse atmospheric measurements. Things might change soon, though, with the advent of satellite measurements.

Hi Tom, is replacing income tax with carbon tax can help to mitigate climate change as well as stabilizing economy? It is good if there is simulation scenario suggests that. By the way, why carbon tax is better than Cap & Trade? I think you have mentioned before but I still not get it very well.

Tony – I don’t see a carbon tax as playing a major role in economic stabilization, particularly in our current situation. Even assuming a good use for the revenue, you’d have to raise the carbon tax very quickly to make a difference. With US emissions at about 6 billion tons CO2 per year (see EIA, http://www.eia.doe.gov/environment.html), you’d have to start with a tax on the order of $100/tonCO2 right away to raise the kind of money needed to make a difference. I think that’s a reasonable thing to do in the long run, but not overnight. The short term dislocation caused by an abrupt change in carbon prices could be very costly.

The possibility of abrupt changes in carbon prices is my primary objection to emissions trading. We need a stable emissions price trajectory that provides long term incentives for innovation. We don’t need precise control of emissions in any one year; we just need to get emissions down over the long haul. Emissions trading emphasizes precise short term control, which creates price volatility, and encourages politicians to set weak targets.

It’s definitely possible to make an emissions market behave better. Any mechanism that creates price elasticity (including safety valves) can improve cost effectiveness and price stability, at the expense of some uncertainty in the cap. However, those measures add complexity to what is already a very complex market. I understand that it takes a bureaucracy of ~100 people just to oversee trading in the ETS.

Don’t get me wrong – I’d rather have a cap & trade system than nothing, but I still greatly prefer a carbon tax.