I’ve been reading the Breakthrough Institute’s Waxman Markey analysis, which is a bit spotty* but raises many interesting issues. One comment seemed too crazy to be true: that the W-M strategic reserve is “refilled” with forestry offsets. Sure enough, it is true:

726 (g) (2) INTERNATIONAL OFFSET CREDITS FOR REDUCED DEFORESTATION- The Administrator shall use the proceeds from each strategic reserve auction to purchase international offset credits issued for reduced deforestation activities pursuant to section 743(e). The Administrator shall retire those international offset credits and establish a number of emission allowances equal to 80 percent of the number of international offset credits so retired. Emission allowances established under this paragraph shall be in addition to those established under section 721(a).

This provision makes the reserve nearly self-perpetuating: at constant prices, 80% of allowances released from the reserve are replaced. If the reserve accomplishes its own goal of reducing prices, more than 80% get replaced (if replacement exceeds 100%, the excess is vintaged and assigned to future years). This got me wondering: does anyone understand how the reserve really works? Its market rules seem arbitrary. Thus I set out to simulate them.

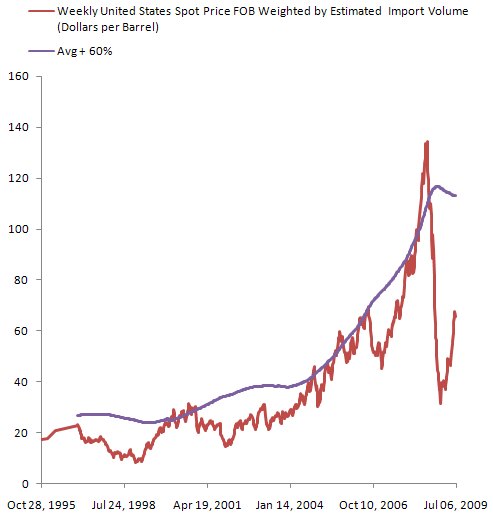

First, I took a look at some data. What would happen if the reserve strategy were applied to other commodities? Here’s oil:

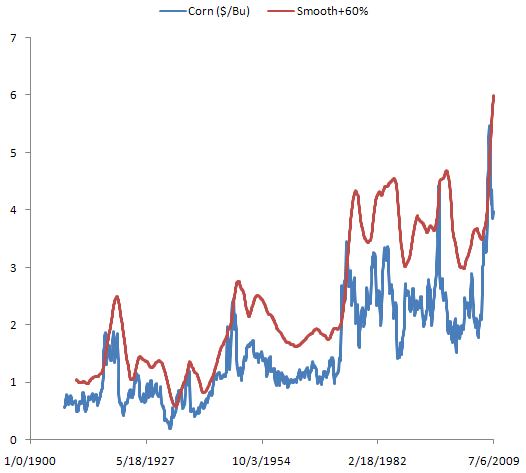

Red is the actual US weekly crude price, while purple shows the strategic reserve price trigger level: a 3-year moving average + 60%. With this trajectory, the reserve would be shaving a few peaks, but wouldn’t do anything about the long term runup in prices. Same goes for corn:

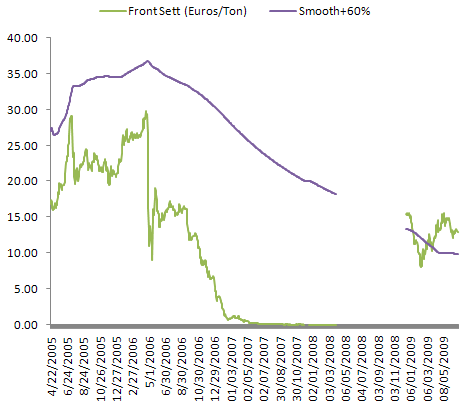

For the EU ETS, it’s hard to say what would happen to spot prices, because the market had an extended near-zero price hiatus:

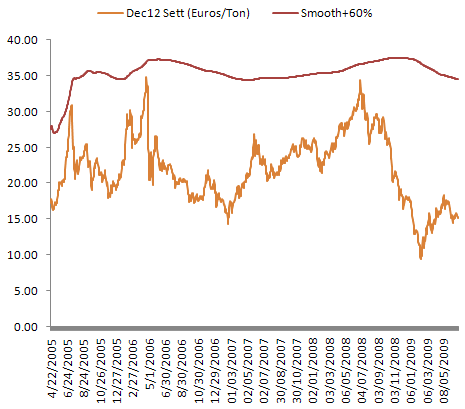

If price volatility looks more like the 2012 futures, the strategic reserve wouldn’t help at all. Yet, does it make sense to have a carbon price this volatile?

Hmmm… So far, this is all open-loop. Next up: crude simulations of the market.

* For example, their claim that coal increases under W-M is a red herring, because all of the increase occurs in 2010 (prior to the cap), and coal emissions and generation is universally lower under W-M than BAU. [Update: see also the startling conclusion of this series.]

Can something like the reserve be used to maintain the price between boundaries? Trigger sale of permits when price goes over a certain level, and buy permits if it goes below a certain threshold? Don’t get me wrong, I really don’t understand how it works.

I think you’re not alone – I don’t think anyone understands how it works. I think it’s possible in principle to design a working mechanism that reduces volatility, but I’m not sure what it should look like yet. See my subsequent posts.