Since it was the Breakthrough analysis that got me started on this topic, I took a quick look at it again. Their basic objection is:

Therein lies a Catch-22 of ACES: if the annual use of up to 2 billion tons of offsets permitted by the bill is limited due to a restricted supply of affordable offsets, the government will pick up the slack by selling reserve allowances, and “refill” the reserve pool with international forestry offset allowances later. […]

The strategic allowance reserve would be established by taking a certain percentage of allowances originally reserved for the future — 1% of 2012-2019 allowances, 2% of 2020-2029 allowances, and 3% of 2030-2050 allowances — for a total size of 2.7 billion allowances. Every year throughout the cap and trade program, a certain portion of this reserve account would be available for purchase by polluters as a “safety valve” in case the price of emission allowances rises too high.

How much of the reserve account would be available for purchase, and for what price? The bill defines the reserve auction limit as 5 percent of total emissions allowances allocated for any given year between 2012-2016, and 10 percent thereafter, for a total of 12 billion cumulative allowances. For example, the bill specifies that 5.38 billion allowances are to be allocated in 2017 for “capped” sectors of the economy, which means 538 million reserve allowances could be auctioned in that year (10% of 5.38 billion). In other words, the emissions “cap” could be raised by 10% in any year after 2016.

First, it’s not clear to me that international offset supply for refilling the reserve is unlimited. Section 726 doesn’t say they’re unlimited, and a global limit of 1 to 1.5 GtCO2eq/yr applies elsewhere. Anyhow, given the current scale of the offset market, it’s likely that reserve refilling will be competing with market participants for a limited supply of allowances.

Second, even if offset refills do raise the de facto cap, that doesn’t raise global emissions, except to the extent that offsets aren’t real, additional and all that. With perfect offsets, global emissions would go down due to the 5:4 exchange ratio of offsets for allowances. If offsets are really rip-offsets, then W-M has bigger problems than the strategic reserve refill.

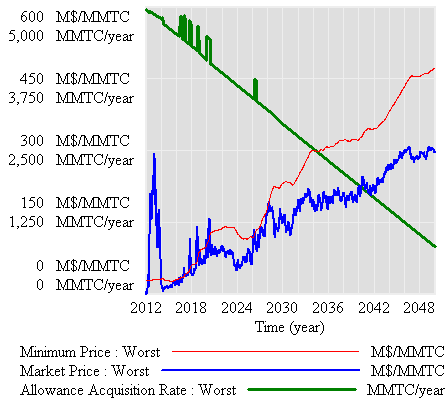

Third, and most importantly, the problem isn’t oversupply of allowances through the reserve. Instead, it’s hard to get allowances out of the reserve – they check in, and never check out. Simple math suggests, and simulations confirm, that it’s hard to generate a price trajectory yielding sustained auction release. Here’s a test with 3%/yr BAU emissions growth and 10% underlying demand volatility:

Even with these implausibly high drivers, it’s hard to get a price trajectory that triggers a sustained auction flow, and total allowance supply (green) and emissions hardly differ from from the no-reserve case.

My preliminary simulation experiments suggest that it’s very unlikely that Breakthrough’s nightmare, a 10% cap violation, could really occur. To make that happen overall, you’d need sustained price increases of over 20% per year – i.e., an allowance price of $56,000/TonCO2eq in 2050. However, there are lesser nightmares hidden in the convoluted language – a messy program to administer, that in the end fails to mitigate volatility.

Tom,

I’ve been reading and rereading your views on the reserve mechanism in the Waxman bill (HR2454, ACES) and you comments on the surprises in the Kerry-Lieberman Senate Bill (the APA). Your views are pretty clear about the proposed price containment mechanism — the proposed acquisition of allowances to be placed in a reserve to limit upward price excursions will simply not do much to limit the allowance price under extreme situations (i.e, the emissions cap is too ambitious with available technologies).

What do you recommend for a price celing? Are you looking for a larger reserve? Or is that simply self-defecating for the reasons explained in your blog?

You used “GASP” in referring to the possibility of letting actual emissions exceed the emissions cap during periods when there is too much upward pressure on the allowance price. What was the meaning of GASP? Are you reminding us that letting the emission target be exceeded is the obvious answer to the price containment challenge? And are you thinking that failure to meet the annual emissions target for several years (or perhaps for a decade) is not a serious failure for a long-lived GHG like CO2?

Hi Andy –

I think the reserve is too small (like the strategic petroleum reserve) to help much, and making it bigger would just make management issues bigger.

I actually wouldn’t mind letting price clear the market, at whatever level, even though it’s inefficient to have a lot of volatility. I just worry that the market price could exceed political will to sustain the system.

The GASP is because exceedance of the cap, as would occur with a hard price ceiling that provides unlimited allowances at the cap, violates the notion of “environmental certainty,” though I don’t put much stock in that.

https://metasd.com/2008/11/news-flash-there-is-no-environmental-certainty/

The real risk is that the price ceiling would be set too low, based on excessive optimism about abatement potential.

I still think an adaptive tax would be better all around – set rough targets for emissions, concentrations, and temperature, and adjust the tax to meet those. (Essentially, this would be a PID controller, providing a more stable price, that would nonetheless escalate inexorably until the job got done).

I think an interesting compromise for a cap & trade system would be to have a schedule of allowances that become available at a price cap. This would create some price elasticity at the cap, which would greatly mitigate extreme excursions. At the same time, as long as the supply curve is fairly steep, the integrity of the cap would be approximately preserved.