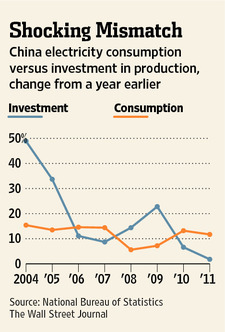

The WSJ has an article on the Chinese electric power sector that’s anecdotally interesting. It notes that increasing electricity prices would spur investment, creating a win-win for energy intensity and system reliability. Maybe so, but the supporting graph is an interesting example of statistics that are uninformative because they fail to account for bathtub dynamics. Here it is:

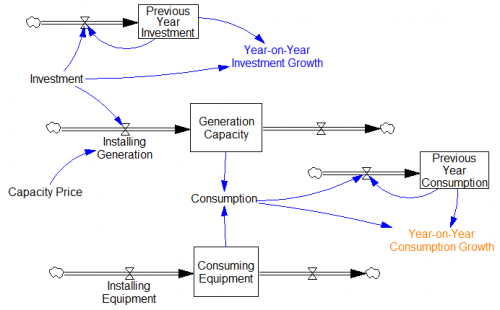

It seems plausible to compare investment and consumption, until you look at the system structure:

It seems plausible to compare investment and consumption, until you look at the system structure:

This indicates four problems with drawing conclusions from the plot:

This indicates four problems with drawing conclusions from the plot:

- Investment is not necessarily the same thing as installation of capacity, unless you assume constant price.

- Consumption is essentially a direct function of stocks of consuming equipment and generating capacity, while investment is a flow. While there’s reason to expect growth rates of stocks and flows to match along a steady state growth path, this only applies in the very long term; in the short run, noise and disequilibrium will destroy any correspondence.

- The thing we do care about is the match between generating capacity and consuming equipment, but that depends on outflows (retirements of capacity) as well as inflows, so again the stock-flow comparison tells us nothing.

- There’s an additional level of indirection because we don’t see investment and consumption directly; the graph shows year-on-year changes. But that means that we’re seeing the slopes of investment and consumption, which tell us nothing about their absolute levels. So, it’s possible that investment growth is falling because it was much too high, and that consumption is growing because there’s excess generating capacity.

The best you can say about this graph is that it doesn’t contradict the article; otherwise it’s almost completely uninformative about the true state of the Chinese power system. It would be far better to have a direct comparison of generating and consuming capacity, or perhaps the growth rate of consumption (which is the net flow of consuming equipment) vs. investment in absolute terms.