China is rapidly eliminating old coal generating capacity, according to Technology Review.

Coal still meets 70 percent of China’s energy needs, but the country claims to have shut down 60 gigawatts’ worth of inefficient coal-fired plants since 2005. Among them is the one shown above, which was demolished in Henan province last year. China is also poised to take the lead in deploying carbon capture and storage (CCS) technology on a large scale. The gasifiers that China uses to turn coal into chemicals and fuel emit a pure stream of carbon dioxide that is cheap to capture, providing “an excellent opportunity to move CCS forward globally,” says Sarah Forbes of the World Resources Institute in Washington, DC.

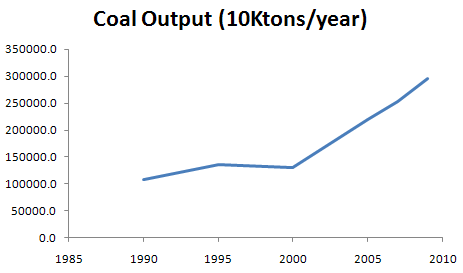

That’s laudable. However, the inflow of new coal capacity must be even greater. Here’s the latest on China’s coal output:

China Statistical Yearbook 2009 & 2009 main statistical data update

That’s just a hair short of 3 billion tons in 2009, with 8%/yr growth from ’07-’09, in spite of the recession. On a per capita basis, US output and consumption is still higher, but at those staggering growth rates, it won’t take China long to catch up.

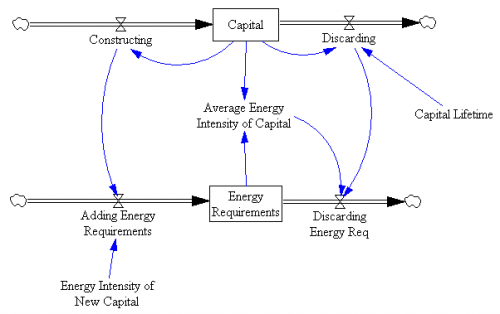

A simple model of capital turnover involves two parallel bathtubs, a “coflow” in SD lingo:

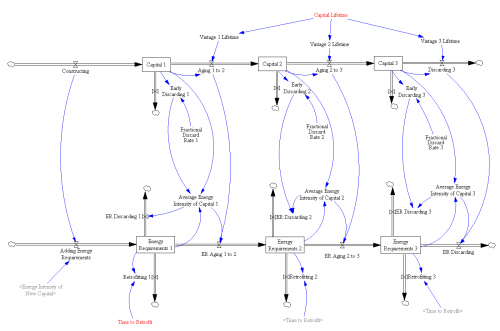

Every time you build some capital, you also commit to the energy needed to run it (unless you don’t run it, in which case why build it?). If you get fancy, you can consider 3rd order vintaging and retrofits, as here:

To get fancier still, see the structure in John Sterman’s thesis, which provides for limited retrofit potential (that Gremlin just isn’t going to be a Prius, no matter what you do to the carburetor).

The basic challenge is that, while it helps to retire old dirty capital quickly (increasing the outflow from the energy requirements bathtub), energy requirements will go up as long as the inflow of new requirements is larger, which is likely when capital itself is growing and the energy intensity of new capital is well above zero. In addition, when capital is growing rapidly, there just isn’t much old stuff around (proportionally) to throw away, because the age structure of capital will be biased toward new vintages.

Hat tip: Travis Franck