I’m rereading some of the history of global modeling, in preparation for the SD conference.

From Models of Doom, the Sussex critique of Limits to Growth:

Marie Jahoda, Chapter 14, Postscript on Social Change

The point is … to highlight a conception of man in world dynamics which seems to have led in all areas considered to an underestimation of negative feedback loops that bend the imaginary exponential growth curves to gentler slopes than “overshoot and collapse”. … Man’s fate is shaped not only by what happens to him but also by what he does, and he acts not just when faced with catastrophe but daily and continuously.

Meadows, Meadows, Randers & Behrens, A Response to Sussex:

The Sussex group confuses the numerical properties of our preliminary World models with the basic dynamic attributes of the world system described in the Limits to Growth. We suggest that exponential growth, physical limits, long adaptive delays, and inherent instability are obvious, general attributes of the present global system.

Who’s right?

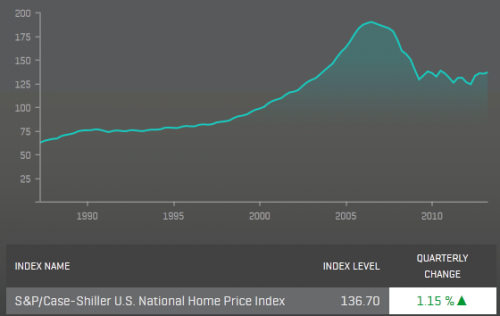

I think we could all agree that the US housing market is vastly simpler than the world. It lies within a single political jurisdiction. Most of its value is private rather than a public good. It is fairly well observed, dense with negative feedbacks like price and supply/demand balance, and unfolds on a time scale that is meaningful to individuals. Delays like the pipeline of houses under construction are fairly salient. Do these benign properties “bend the imaginary exponential growth curves to gentler slopes than ‘overshoot and collapse'”?

Hmmm… apparently not. Though what will it look like a hundred year from now?

Right … presumably it resumes an upward trend, as long as GDP does, because the crash isn’t driven by any fundamental limit. But if overshoot and collapse is possible without that, why should it be impossible with limits?

Agreed. To deny that overshoot and collapse does not occur as a result of human activity isn’t sensible. Calling exponential growth imaginary is also like denying that 4+4=8 (my spam challenge).

At the same time looking from long time scales (e.g. geological), many exponential phenomenon end up looking like small bumps along more linear growth.

Given that, both perspectives can still be right, but it’s comparing apples to oranges. For instance, prior to the Black Death, had there been records like we have today I’m sure population growth looked exponential with an overshoot and collapse like behavior.

In the long scale, however, it was just a blip in a period of now seemingly linear growth. The same is true of the great depression.

I guess my point is that as we discuss limits to growth we have to not sound like we are predicting the end of all civilization. We are just predicting a period where the relative pain and suffering is both A) larger than any scale in our past (and the Black Death was pretty horrific) and B) largely avoidable if we plan more carefully now.

If we manage to survive even a few hundred thousand more years, we will likely be interplanetary and possibly even interstellar and no matter what happens in the next few millennia, it will look like the Black Death does to us now.

The real question then is do we want to be learn an extremely painful lesson in the future, or start being smart now?

To be clear though, I don’t think the Sussex group was taking this long term perspective, but instead were being rather naive about the speed in which our negative feedback loops work on a social scale. You only have to look around to see that now.

Right … the counterargument is that any move toward material equilibrium will hinder achieving asteroid mining or some other tech that permits a footprint bigger than one earth. But the time scales have to work out just right, in order to use planetary overshoot to achieve liftoff, so to speak. Risky game. Also, it’s not really clear how avoiding internalizing externalities now actually helps tech progress.

Yup, I think it’s actually pretty obvious that the opposite is true. By cutting ourselves off old tech/energy sooner we can not only reduce risk, but actually stimulate tech progress.

It’s about providing focus. I think groups like Sussex and Co have a tendency to overstate the speed of balancing feedback, while we too often overstate the reinforcing risks.

I’m not suggesting we simply ignore the risks and count on a tech miracle, we just need to avoid being boxed into an “either or” proposition.

We need “both and” solutions and the SD community is only one I see capable of demonstrating what a balanced approach looks like.

The really sad thing is that so many policies that would tend towards material equilibrium are win-win, in that they make people happier and healthier through improved technology (broadly, but perhaps more methods of getting along than hardware).

Exactly! Thats where we need to shift the dialogue. Letting the opposition continue to debate the science is like arguing if the sky is blue. President Obama actually put it fairly well when he said: “We don’t have time for a meeting of the flat-earth society.”

I just have doubts about our current political system’s ability to get the policy right. Hope we can connect next week to discuss this more.

Picking up on your housing market model idea, you might look at housing starts, as well. In about 2008, I used that as an introductory example in a course I taught at UW. It certainly wasn’t overly vetted, but the essence (as I recall it) was simple: if you have builders focused on achieving a fixed CAGR, if they also stop building if housing sales drop (say, as measured by time on market), and if there is a delay in perceiving and responding to a drop in sales, you can create boom and bust. If you add in slowly growing population, you create a sort of relaxation oscillator, and you can reproduce real estate cycles. Adjusting delays and desired CAGR can attenuate but not eliminate those cycles, at least in any meaningful way.

Changing from a system driven by a positive loop with a brake provided by sensing overcapacity with delay to a system driven by a negative feedback loop (build houses to meet expected population needs, not business desires for a fixed growth rate) made the cycles disappear cleanly.

I think that goes partway to demonstrating that a growth-oriented system that relies on delayed perceptions of limits doesn’t allow for smooth adjustment, even in non-extraordinary times. I created the example in about 2008, when it looked like we might be seeing a housing correction. I think I used it again in 2009, when the downward movement wouldn’t stop, and I noted that I should really improve the model to handle these new circumstances. I don’t think I used the example at all in 2010. :-%