The NYT reports that Hillary Clinton and John McCain have lined up to suspend federal excise taxes on fuel:

Senator Hillary Rodham Clinton lined up with Senator John McCain, the presumptive Republican nominee for president, in endorsing a plan to suspend the federal excise tax on gasoline, 18.4 cents a gallon, for the summer travel season. But Senator Barack Obama, Mrs. Clinton’s Democratic rival, spoke out firmly against the proposal, saying it would save consumers little and do nothing to curtail oil consumption and imports.

…

Mrs. Clinton would replace that money with the new tax on oil company profits, an idea that has been kicking around Congress for several years but has not been enacted into law. Mr. McCain would divert tax revenue from other sources to make the highway trust fund whole.

On April 22, EIA data put WTI crude at $119/bbl, which is $2.83/gal before accounting for refinery losses. Spot gasoline was at $2.90 to $3.14 (depending on geography and type), which is about what you’d expect with total taxes near $0.50 and retail gasoline at $3.55/gal. With refinery yields typically at something like 85%, you’d actually expect spot gasoline to be at about $3.30, so other, more-expensive products (diesel, jet fuel, heating oil) or cheaper feedstocks must be making up the difference. The price breaks down roughly as follows:

“Other” includes refinery losses (which should actually be attributed in part to crude), distribution, other taxes, profit, etc. There just isn’t a lot of room between the cost of crude and the cost of gasoline, so it’s hard to believe that eliminating the excise tax is going to make much difference. The potential 5% price reduction from cutting the tax may not even be realized under the Clinton option (replacing the money with a windfall profits tax), because suppliers will adjust their pricing and investment to offset the new tax. The McCain proposal is even worse, because it subsidizes driving by funding highways from general revenue. Whether you’re a capitalist or environmentalist, the tax cut sends the wrong economic signals – that roads are free, externalities don’t matter, the government will bail out drivers, etc.

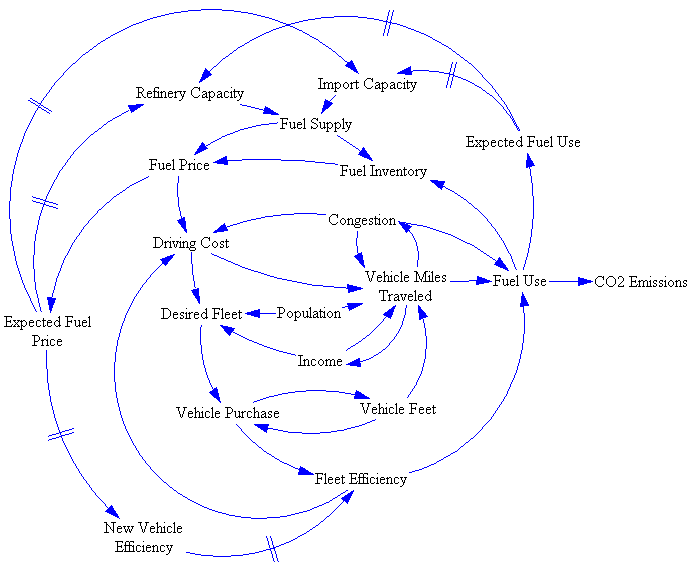

Sending the wrong signals probably has little effect in the short run; if the price elasticity of fuel demand is low (<0.1), the tax cut would increase US consumption by at most 0.5%. However, in the long run, it can trigger quite significant effects on fuel economy, supply, land use, and other behaviors connected with driving: