Author: Tom

Electric Car Wisdumb

The current McKinsey Quarterly feature’s Andy Grove’s editorial, An electric plan for energy resilience. An excerpt:

We believe the United States should consider accelerating this movement by creating an industry of after-market retrofitters. What problems’”technical and economic’”would need to be solved in order to do that? With the help of a team of second-year graduate students in our Bass seminar at the Stanford Business School, we examined this question in the context of a proposed pilot program, whose aim would be to retrofit one million vehicles in three years. We felt that such a project would represent what in game theory is referred to as the ‘minimum winning game’: a significant step toward a long-term strategic objective (see sidebar, ‘Inside Andy’s real-world seminar’).

We estimate the price tag of such a pilot project to be around $10 billion, owing to the present high cost of batteries, which are around $10,000 each. One might expect such costs to drop as volume increases, but because this program is accelerated by design, we have to assume that batteries will remain expensive. Assuming an average gas price of $3 per gallon, the payback period to the owner of a retrofitted vehicle is at least ten years, not a strong economic incentive. But the benefits of this program’”testing and validating a key approach to energy resilience’”accrue to the well-being of the United States at large. As the general population is the predominant beneficiary, economic assistance flowing from everyone to vehicle owners, in the form of tax incentives, is justified.

There are different approaches to retrofitting vehicles. We favor GM’s Volt design, in which the car is directly driven by an electric motor. The vehicle’s existing gasoline engine is replaced by a smaller one, whose sole purpose is to generate electricity and recharge the battery. To simplify the retrofitting task, we would limit the scope of the program to six to ten Chevrolet, Ford, and Dodge models, selected on the basis of two criteria: low fuel efficiency and large numbers of vehicles on the road. Most of these vehicles would be SUVs, pick-ups, and vans.

There’s some wisdom in this proposal, particularly in the recognition that achieving an alt fuel vehicle transformation takes more than a few inventions; it requires changes in infrastructure, marketing, and a variety of other domains, each with bugs to be worked out:

Others wondered why we should bother retrofitting a million cars if that would deal only with a fraction of a percent of the existing cars. That’s one way to look at it. Another, which was the view our students took, is that it is important to strive to do enough conversions that we can encounter all the unknown unknowns, which in my experience characterize every new product or technology as it gets scaled into volume. Should it be 5 million? Should it only be 500,000? We picked a million as a number that is big enough to stress retrofitting capability, battery production capability, manufacturing issues and marketing issues. We described our aim as the ‘minimum winning game’ that would give us a platform from which we could scale further.

However, the retrofit idea strikes me as fundamentally flawed. Targeting low efficiency SUVs, pick-ups, and vans puts batteries exactly where they’d be least effective. If most such vehicles weren’t overweight, un-aerodynamic, saddled with lossy AWD, and bloated with power-hungry accessories, they’d already get decent fuel economy. Adding batteries to them is going to result in some combination of high cost, short range, and poor performance. That sounds like a sure way to poison the public perception of plug in electric vehicles.

RMI has been arguing for years that a coordinated set of chassis innovations could make powertrains with high cost-per-watt, like fuel cells, attractive. It’s no accident that that the only really successful hybrid vehicle (the Prius, responsible for over half of 2007 and 2008 hybrid sales) was designed from scratch. It gets its breakthrough mileage/performance combination from much more than a battery and motor. Lightweight materials, aerodynamics, low rolling resistance tires, and other innovations are also key.

I think Grove and his students are falling for a common fantasy: that technology will step up and allow us to drive exactly as we now do, fossil-free. I personally doubt that will happen. Arnold will probably be one of only a few to ever drive a hydrogen Hummer. The rest of us will have to recognize that if alt fuel vehicles are to accomplish anything really meaningful from an energy standpoint, they’ll be different, as will our land use, commuting, and travel habits.

With that in mind, we should be focusing on creating the new stuff, not fixing the old. That might mean the Chevy Volt, but it might also mean rail or telecommuting. Rather than setting up programs to achieve narrow goals, I’d rather see broad, credible signals (e.g., prices at the pump reflecting environmental and security values) guide the evolution of the new from the bottom up.

Improbable Grosbeak

A large flock of evening grosbeaks seems to have decided to winter at our place. Here’s one.

Live from Poznan

I’ll be there next week, but COP14 is already underway.

Nature has an editorial and an interview with Yvo de Boer, UNFCC executive secretary.

COP14 HQ

Poznan city guide

Local governments are here.

Twitter PoznanWeb and 350.org and DeSmogBlog

Topix newswire

Four Legs and a Tail

An effective climate policy needs prices, technology, institutional rules, and preferences.

I’m continuously irked by calls for R&D to save us from climate change. Yes, we need it very badly, but it’s no panacea. Without other signals, like a price on carbon, technology isn’t going to do a lot. It’s a one-legged dog. True, we might get lucky with some magic bullet, but I’m not willing to count on that. An effective climate policy needs four legs:

- Prices

- Technology (the landscape of possibilities on which we make decisions)

- Institutional rules and procedures

- Preferences, operating within social networks

The Recession is Official

From Econbrowser: “The Business Cycle Dating Committee of the National Bureau of Economic Research announced today that the eleventh U.S. postwar recession began in December of 2007.” Of course, if you live in a general equilibrium model, you already knew that.

How Not To Play the Policy Game

Drew and Beth showed me this funny video while we were working in Copenhagen. It’s a perfect metaphor for how policy processes go wrong, when everyone jumps straight to detailed analysis (the binoculars) and no one has a big picture of the system outside their own stovepipe (other players, the game field).

Parting Shot

I’m off to Copenhagen for a week, with Drew Jones & Beth Sawin of SI – getting ready for Poznan and Copenhagen 2009.

News Flash: There Is No "Environmental Certainty"

The principal benefit cited for cap & trade is “environmental certainty,” meaning that “a cap-and-trade system, coupled with adequate enforcement, assures that environmental goals actually would be achieved by a certain date.” Environmental certainty is a bit of a misnomer. I think of environmental certainty as ensuring a reasonable chance of avoiding serious climate impacts. What people mean when they’re talking about cap & trade is really “emissions certainty.” Unfortunately, emissions certainty doesn’t provide climate certainty:

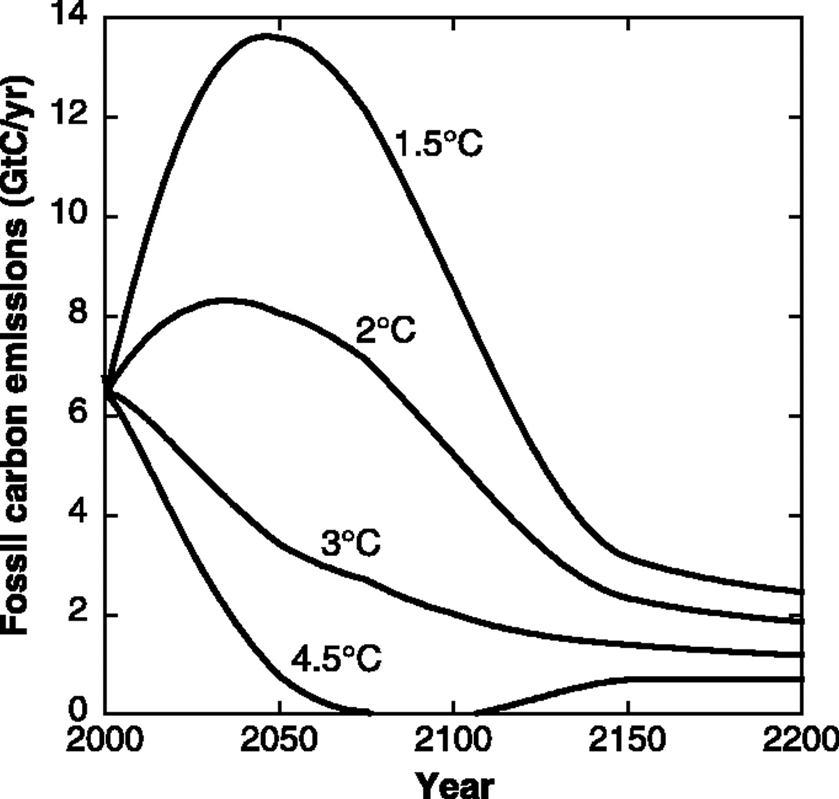

Even if we could determine a “safe” level of interference in the climate system, the sensitivity of global mean temperature to increasing atmospheric CO2 is known perhaps only to a factor of three or less. Here we show how a factor of three uncertainty in climate sensitivity introduces even greater uncertainty in allowable increases in atmospheric CO2 CO2 emissions. (Caldeira, Jain & Hoffert, Science)

The uncertainty about climate sensitivity (not to mention carbon cycle feedbacks and other tipping point phenomena) makes the emissions trajectory we need highly uncertain. That trajectory is also subject to other big uncertainties – technology, growth convergence, peak oil, etc. Together, those features make it silly to expend a lot of effort on detailed plans for 2050. We don’t need a ballistic trajectory; we need a guidance system. I’d like to see us agree to a price on GHGs everywhere now, along with a decision rule for adapting that price over time until we’re on a downward emissions trajectory. Then move on to the other legs of the stool: ensuring equitable opportunities for development, changing lifestyle, tackling institutional barriers to change, and investing in technology.

Unfortunately, cap & trade seems ill-suited to adaptive control. Emissions commitments and allowance allocations are set in multi-year intervals, announced in advance, with long lead times for design. Financial markets and industry players want that certainty, but the delay limits responsiveness. Decision makers don’t set the commitment by strictly environmental standards; they also ask themselves what allocation will result in an “acceptable” price. They’re risk averse, so they choose an allocation that’s very likely to lead to an acceptable price. That means that, more often than not, the system will be overallocated. On balance, their conservatism is probably a good thing; otherwise the whole system could unravel from a negative public reaction to volatile prices. Ironically, safety valves – one policy that could make cap & trade more robust, and thus enable better mean performance – are often opposed because they reduce emissions certainty.

Cap & Trade – How Soon?

I’m a strong advocate for a price on carbon, but I have serious reservations about cap & trade. I’m thrilled that climate policy is finally getting off the dime, but I wish enthusiasm were focused on a carbon tax instead. Consider this:

| Jurisdiction | Instrument | Started | Operational | Status |

| EU | Cap & Trade | 2003 | 2005 | Phase 1 overallocated & underpriced; still wrangling over loopholes for subsequent phases |

| British Columbia | Tax | Feb 2008 | July 2008 | Too low to do much yet, but working |

| Sweden | Tax | 1991 | 1991 | Running, at $150/TonCO2; emissions down |

| RGGI | Cap & Trade | 2003 | 2008 | Overallocated |

| Norway | Tax | 1990 | 1991 | Works; not enough to lower emissions substantially |

| California | Cap & Trade (part of AB32) | 2007 | Earliest 2012 | Punted |

| WCI | Cap & Trade | 2007 | Earliest 2012 | Draft design |

The pattern that stands out to me is timing – cap & trade systems are slow to get out of the gate compared to carbon taxes. They entail huge design challenges, which often restrict sectoral coverage. Price uncertainty makes it difficult to work out the implications of allowance allocation (unless you go to pure auction, in which case you lose the benefit of transitional grandfathering as a mechanism to buy carbon-intensive industry participation). I think we’ll be lucky to see an operational cap & trade system in the US, with meaningful prices and broad coverage, by the end of the first Obama administration.