From the latest National Journal‘s Congressional Insiders Poll. Perhaps this is another special case of the general phenomenon of elites being more politically polarized.

Category: Climate

Effects of Global Change on the US

The Climate Change Science Program web site has the newly-released Scientific Assessment of the Effects of Global Change on the United States frontpage, along with a Revised Research Plan for the CCSP.

SRES – We've got a bigger problem now

Recently Pielke, Wigley and Green discussed the implications of autonomous energy efficiency improvements (AEEI) in IPCC scenarios, provoking many replies. Some found the hubbub around the issue surprising, because the assumptions concerned were well known, at least to modelers. I was among the surprised, but sometimes the obvious needs to be restated loud and clear. I believe that there are several bigger elephants in the room that deserve such treatment. AEEI is important, as are other hotly debated SRES choices like PPP vs. MEX, but at the end of the day, these are just parameter choices. In complex systems parameter uncertainty generally plays second fiddle to structural uncertainty. Integrated assessment models (IAMs) as a group frequently employ similar methods, e.g., dynamic general equilibrium, and leave crucial structural assumptions untested. I find it strange that the hottest debates surround biogeophysical models, which are actually much better grounded in physical principles, when socio-economic modeling is so uncertain.

Better Get a Bucket

Nature News and Climate Feedback report that cooling of sea surface temperatures ca. 1945 is an artifact of changes in measurement technology. ClimateAudit claims priority. Lucia comments.

Will this – like the satellite temperature trend – be another case of model-data discrepancies resolved in favor of the models?

Update: Prometheus wonders if this changes IPCC conclusions.

Business & Climate – What to Wish For?

One observation from my recent experience with climate policy in California is that businesses – even energy intensive ones – are uncertain how to engage in the public debate. Climate policy is a messy space with many competing options, and it’s hard to know what to wish for. With that in mind, here’s a quick survey of what various business groups are saying.

God is my coauthor

DeSmogBlog documents scientists’ outrage at inclusion on Dennis Avery’s list of 500 Scientists with Documented Doubts of Man-Made Global Warming Scares. Amusingly, the scientists concerned, a few of whom are deceased, are listed as “Co-Authors”. I’m going to put this new “open coauthoring” concept to work – I’m already working on abstracts. First, I think I’ll lower my Erdős number – Paul, dude, you can be my second. Next, I think I’ll team up with Einstein and Bohr to finish up quantum gravity.

Glacier News

A pair of papers in Science this week refines the understanding of the acceleration of glacier flow from lubrication by meltwater. The bottom line:

Now a two-pronged study–both broader and more focused than the one that sounded the alarm–has confirmed that meltwater reaches the ice sheet’s base and does indeed speed the ice’s seaward flow. The good news is that the process is more leisurely than many climate scientists had feared. “Is it, ‘Run for the hills, the ice sheet is falling in the ocean’?” asks glaciologist Richard Alley of Pennsylvania State University in State College. “No. It matters, but it’s not huge.” The finding should ease concerns that Greenland ice could raise sea level a disastrous meter or more by the end of the century. Experts remain concerned, however, because meltwater doesn’t explain why Greenland’s rivers of ice have recently surged forward.

A remarkable excerpt:

The meltwater monitoring caught a 4-kilometer-long, 8-meter-deep lake disappearing into the ice in an hour and a half. As theorists had supposed, once the lake water was deep enough, its weight began to wedge open existing cracks, which only increased the weight of overlying water on the crack tip and accelerated cracking downward. Once the main crack reached the bottom of the ice, heat from churning water flow melted out parts of the fracture, and drainage took off. The lake disappeared in about 1.4 hours at an average rate of 8700 cubic meters per second, exceeding the average flow over Niagara Falls. That’s almost four Olympic pools a second.

Check it out (subscription required).

The Volunteers Have No Clothes

Naked Capitalism asks Why Companies Aren’t Fighting Climate Change, citing interesting new work by Karin Thorburn and Karen Fisher-Vanden, which indicates that firms lose value when undertaking (or at least signaling) greenhouse gas emissions reductions.

Specifically, we studied the stock market’s reaction when companies joined Climate Leaders, a voluntary government-industry partnership in which firms commit to a long-term reduction of their greenhouse gas emissions. Importantly, when the firms announced to the public that they were joining Climate Leaders their stock prices dropped significantly.

Naked Capitalism concludes that, “the stock market doesn’t get it.” Thorburn and Fisher-Vanden actually go a little further,

The negative market reaction for firms joining Climate Leaders reveals that the reduction of greenhouse gases is a negative net present value project for the company. That is, the capital expenditures required to cut the carbon footprint exceed the present value of the expected future benefits from these investments, such as lower energy costs and increased revenue associated with the green goodwill. Some may argue that the decline in stock price is simply evidence that the market is near-sighted and ignores the long-term benefits of the green investments. Notice, however, that the stock market generally values uncertain cash flows in a distant future despite large investments today: earlier work has shown that firms announcing major capital expenditure programs and investments in research and development tend to experience an increase in their stock price. Similarly, the stock market often assigns substantial value to growth companies with negative current earnings, but with potential profits in the future. In fact, only two percent of the publicly traded firms in the United States have joined the Climate Leaders program to date, supporting our observation that initiatives aimed at curbing greenhouse gas emissions largely are value decreasing.

I personally don’t drink enough of the economic Kool-aid to take it on faith that market perceptions are consistently right. For one thing, high oil prices haven’t been around for very long, which means that firms haven’t had a lot of time to take profitable actions. Markets haven’t had a lot of time to believe in the staying power of high oil prices or to separate the effects of firms’ energy and carbon efficiency initiatives from the noisy background. Expectations could easily be based on a bygone era. However, even if there are some $20 bills on the sidewalk at present, Thorburn and Fisher-Vanden are certainly correct in the long run: emissions reductions will entail real costs at some point. Continue reading “The Volunteers Have No Clothes”

Plus ça change, plus c’est la même chose

Last Wednesday, President Bush called for the US to halt the growth of greenhouse gas emissions by 2025:

‘It is now time for the U.S. to look beyond 2012 and take the next step,’ Mr. Bush said, a reference to his previously stated national goal, announced in 2002, of an 18 percent reduction in the growth of emissions of heat-trapping gases relative to economic growth by 2012. Mr. Bush said the nation was on track to meeting that target. – NYT

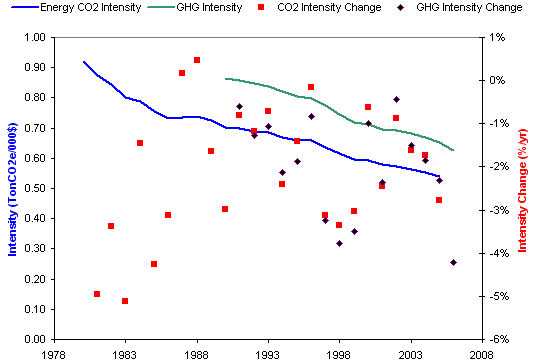

Those who remember the 2002 commitment may recall that, at the time, emissions intensity had historically fallen by 1.3% per year on its own, so that the administration policy actually committed only to an additional 0.4% decline (assuming continuity with history). With GDP growth at about 3% per year, that would leave absolute emissions growing at about 1.7% per year. In fact, intensity has fallen about 2.5% per year since 2002, with much of that in 2006. Since it’s way too soon for investments in climate-related R&D to be having any effect, it’s likely that the savings are due to $100 oil. That is not an emissions reduction method that is likely to pass a cost-benefit test.

In the context of the long term,-2.5% over 4 years is still hard to separate from noise. Continue reading “Plus ça change, plus c’est la même chose”

Trade Emissions & Cosmic Rays

Two interesting abstracts I ran across today:

Testing the proposed causal link between cosmic rays and cloud cover

A decrease in the globally averaged low level cloud cover, deduced from the ISCCP infrared data, as the cosmic ray intensity decreased during the solar cycle 22 was observed by two groups. The groups went on to hypothesize that the decrease in ionization due to cosmic rays causes the decrease in cloud cover, thereby explaining a large part of the currently observed global warming. We have examined this hypothesis to look for evidence to corroborate it. None has been found and so our conclusions are to doubt it. From the absence of corroborative evidence, we estimate that less than 23%, at the 95% confidence level, of the 11 year cycle change in the globally averaged cloud cover observed in solar cycle 22 is due to the change in the rate of ionization from the solar modulation of cosmic rays.

Almost one-quarter of carbon dioxide released to the atmosphere is emitted in the production of internationally traded goods and services. Trade therefore represents an unrivalled, and unused, tool for reducing greenhouse gas emissions.