The undead are rising from their graves to attack the living in Montana, and people are still using the Static Reserve Life Index.

http://youtu.be/c7pNAhENBV4

The SRLI calculates the expected lifetime of reserves based on constant usage rate, as life=reserves/production. For optimistic gas reserves and resources of about 2200 Tcf (double the USGS estimate), and consumption of 24 Tcf/year (gross production is a bit more than that), the SRLI is about 90 years – hence claims of 100 years of gas.

How much natural gas does the United States have and how long will it last?

EIA estimates that there are 2,203 trillion cubic feet (Tcf) of natural gas that is technically recoverable in the United States. At the rate of U.S. natural gas consumption in 2011 of about 24 Tcf per year, 2,203 Tcf of natural gas is enough to last about 92 years.

Notice the conflation of SRLI as indicator with a prediction of the actual resource trajectory. The problem is that constant usage is a stupid assumption. Whenever you see someone citing a long SRLI, you can be sure that a pitch to increase consumption is not far behind. Use gas to substitute for oil in transportation or coal in electricity generation!

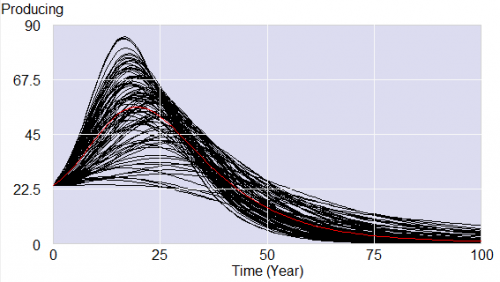

Substitution is fine, but increasing use means that the actual dynamic trajectory of the resource will show greatly accelerated depletion. For logistic growth in exploitation of the resource remaining, and a 10-year depletion trajectory for fields, the future must hold something like the following:

That’s production below today’s levels in less than 50 years. Naturally, faster growth now means less production later. Even with a hypothetical further doubling of resources (4400 Tcf, SRLI = 180 years), production growth would exhaust resources in well under 100 years. My guess is that “peak gas” is already on the horizon within the lifetime of long-lived capital like power plants.

Limits to Growth actually devoted a whole section to the silliness of the SRLI, but that was widely misinterpreted as a prediction of resource exhaustion by the turn of the century. So, the SRLI lives on, feasting on the brains of the unwary.

Okay Tom, to play the devil’s advocate. Can you be certain that there will be logistic growth of natural gas resource exploitation? What would the dynamic look like if we halted growth in consumption and had increases in efficiency and renewable energy that produced a decline in natural gas consumption? I know that’s not how the argument behind such claims is being made, but in some sense isn’t that we ultimately need to do? We already know that renewable energy isn’t enough to satisfy growth.

One argument I think we need to be making is that we’re not talking about collapsing all of the CO2 industry in just a few years. Instead we will be setting it on a trajectory of decline, which may actually extend the life of the industry instead of killing it in a sudden overshoot and collapse. Why not argue for 300 years or more of natural gas instead of a measly 100 that will more likely turn out to be less than 50 given our current behavior?

I agree completely that we should aspire to 100 or 1000 years of gas because we wean ourselves off the remainder efficiently and leave some in the ground.

So, I guess my point is that P(advocating for growth in use in next breath|mentions long SRLI) is high, and that’s an internally inconsistent position.

If there’s going to be growth, the SRLI will be seriously eroded. The worst case assumption, explored in the dynamic reserve life indices in Limits (also here, https://metasd.com/2012/01/static-reserve-life-index-rears-its-ugly-head/ – evidently I have a short memory), is that growth continues to exhaustion. That’s unrealistic. It’s also unrealistic to think that growth continues until limited by field depletion, per https://metasd.com/2008/10/synchronized-drilling/ . So, if there is to be growth, it must be in some sense S-shaped, and the logistic is a convenient, simple representative trajectory. I can’t prove that it won’t be Gompertz or some other generalization, but I doubt that it matters much to the point.

While we’re not talking about collapsing CO2 emissions in a few years, a policy that caused fossil fuel users to pay full costs would probably amount to a collapse of profits and new investment. Muller/Mendelsohn/Nordhaus (last being a fan of growth and enemy of Limits) shows that the coal industry’s value added is quite negative, even at a low social cost of carbon. http://nordhaus.econ.yale.edu/documents/Env_Accounts_021910.doc