Yesterday’s news:

BONN, Germany (Reuters) – China, India and other developing nations joined forces on Wednesday to urge rich countries to make far deeper cuts in greenhouse gas emissions than planned by 2020 to slow global warming.

I’m sure that the mental model behind this runs something like, “the developed world created most of the problem up to this point, and they’re rich, so they should get busy making deep cuts, while we grow a little more to catch up.” Regardless of fairness considerations, that approach ignores the physics of the situation. If developing countries continue to increase emissions, it hardly matters how deep cuts are in the rich world. Either everyone plays along, or mitigation doesn’t work.

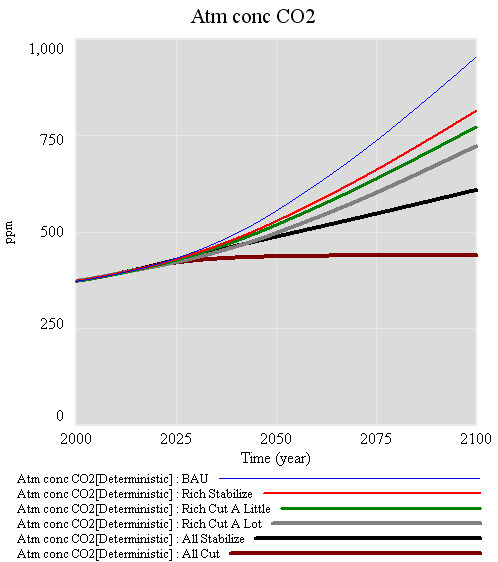

I fired up C-ROADS and ran a few scenarios to illustrate:

The top blue line is the AIFI business-as-usual, with rapid emissions growth. If rich nations stabilize emissions as of today, you get the red line – still much more than 2x CO2 at the end of the century. Whether the rich start cutting emissions a little (1%/yr, green) or a lot (5%/yr, green) after that makes relatively little difference, because emissions from the rich world quickly become a small share of the total. Getting everyone to merely stabilize emissions (at 2009 levels for the rich, 2020 for developing countries, black) makes a substantially bigger difference than deep cuts by the rich alone. Stabilizing CO2 in the atmosphere at a low level requires deep cuts by everyone (here 4%/year, brown).

If we’re serious about stabilization, it doesn’t make sense for the rich to decarbonize faster, so that the developing world can construct more carbon-dependent capital that will ultimately have to be deconstructed. It may sound “fair” in carbon-per-capita terms, but I don’t think that’s a very good measure of human welfare, and it’s unlikely to end up with a fair distribution of damages.

If the developing countries are really concerned about climate impacts (as they should be), they should be looking to the rich world for help getting onto a low-carbon path today, not in 20 years. They should also be willing to impose a carbon price on themselves. It won’t collapse their economies any more than it will ours. Without a price on carbon, rebound effects and leakage will eat up most gains, as the private sector responds to the real signal: “go green (but the price of carbon is zero, wink wink nudge nudge).” Their request to the rich should be about the transfers, property rights, and other changes it takes to get the job done with some measure of distributional fairness (a topic that won’t be popular in some circles).