Stimulus regret seems to be pretty widespread now. The undercurrent seems to be that, because unemployment is still 10% etc., the stimulus didn’t work or at least wasn’t cost effective. This conclusion is based on pattern matching thinking. Pattern matching assumes simple A->B correlation: Stimulus->Unemployment. Working backwards from that assumption, one concludes from ongoing high unemployment and the fact that stimulus did occur that the correlation between stimulus and unemployment is low.

There are two problems with this logic. First, there are many confounding factors in the A->B relationship that could be responsible for ongoing problems. Second, there’s feedback between A and B, which also means that there are (possibly large) intervening stocks (integrations, accumulations). Stocks decouple the temporal relationship between A and B, so that pattern matching doesn’t work .

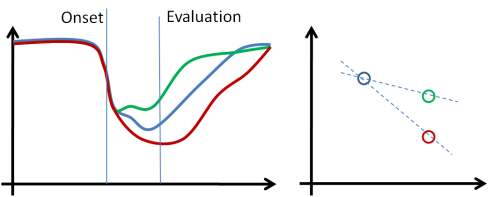

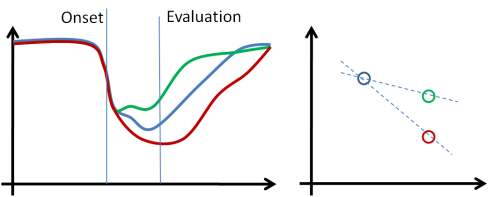

Consider three possible worlds, schematically below. The blue scenario is the economy’s trajectory with no intervention. In the green scenario, stimulus spending is used, and it works, making recovery faster. In the red scenario, stimulus is counterproductive. If one evaluates the stimulus early, without accounting for delays and accumulation, one can’t help but conclude that the stimulus has failed, because things got worse. Pattern matching doesn’t account for the fact that things might have gotten worse more slowly.

For a politician evaluated by people who ignore system structure, this is a no-win situation. As long as things get worse, blame follows, regardless of what policy is chosen.

I’m not arguing that stimulus works, just that the public debate about it is vacuous. There’s little talk about delays, feedback, let alone model-driven discussion of the outcome, i.e. the only perspective through which one can understand the problem is largely confined to a small circle of wonks.