Given its large global presence in 2015, by any measure, China’s posture in the negotiations was critical. The Climate Game Times reported:

China put forth a set of principles yesterday that will guide today’s continued negotiations on migration, disaster relief, resource scarcity, and emissions reductions…. These principles included statements that China’s efforts in these areas will be consistent with its development objectives, and that historical contributions to greenhouse gas emissions be considered in setting targets and dividing the responsibility for global mitigation.

…

In perhaps the most important detail to emerge from yesterday’s negotiations, the China team will continue to lead in pushing for technology transfers for mitigation and adaptation measures, particularly in emissions reductions, in land use and forestry, and in agriculture so as to encourage a new ‘green revolution.’

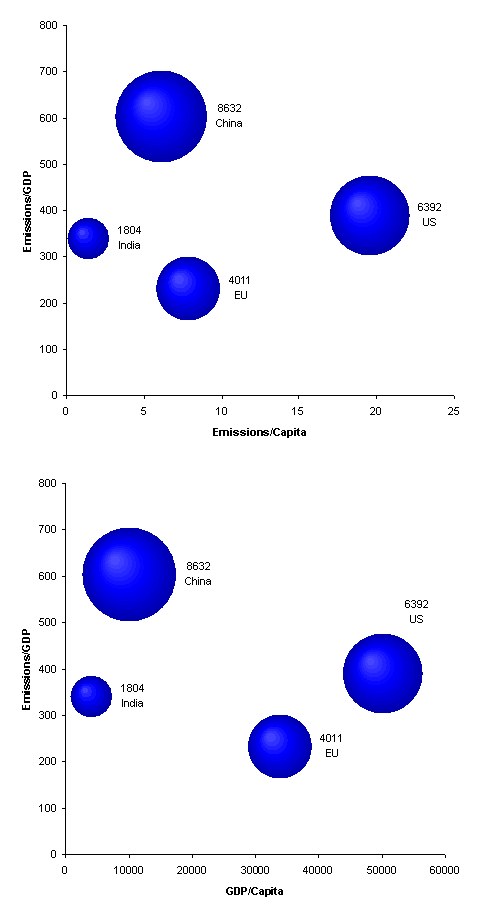

I spent much of my time sitting in on the China team’s deliberations. The discussion was very realistic when viewed in the light of 2008 developing country positions, but I began to wonder whether that position could lead to a good outcome for the people of China. Some underlying assumptions that trouble me: