Balaton Group colleagues Jørgen Nørgård, John Peet & Kristín Vala Ragnarsdóttir have a nice history of The Limits to Growth in Solutions.

Category: Limits

The model that ate Europe

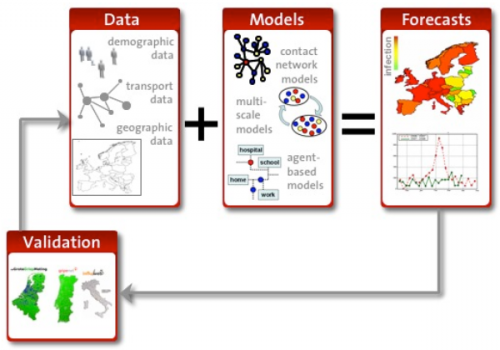

arXiv covers modeling on an epic scale in Europe’s Plan to Simulate the Entire Earth: a billion dollar plan to build a huge infrastructure for global multiagent models. The core is a massive exaflop “Living Earth Simulator” – essentially the socioeconomic version of the Earth Simulator.

I admire the audacity of this proposal, and there are many good ideas captured in one place:

- The goal is to take on emergent phenomena like financial crises (getting away from the paradigm of incremental optimization of stable systems).

- It embraces uncertainty and robustness through scenario analysis and Monte Carlo simulation.

- It mixes modeling with data mining and visualization.

- The general emphasis is on networks and multiagent simulations.

I have no doubt that there might be many interesting spinoffs from such a project. However, I suspect that the core goal of creating a realistic global model will be an epic failure, for three reasons. Continue reading “The model that ate Europe”

Faking fitness

Geoffrey Miller wonders why we haven’t met aliens. I think his proposed answer has a lot to do with the state of the world and why it’s hard to sell good modeling.

I don’t know why this 2006 Seed article bubbled to the top of my reader, but here’s an excerpt:

The story goes like this: Sometime in the 1940s, Enrico Fermi was talking about the possibility of extraterrestrial intelligence with some other physicists. … Fermi listened patiently, then asked, simply, “So, where is everybody?” That is, if extraterrestrial intelligence is common, why haven’t we met any bright aliens yet? This conundrum became known as Fermi’s Paradox.

It looks, then, as if we can answer Fermi in two ways. Perhaps our current science over-estimates the likelihood of extraterrestrial intelligence evolving. Or, perhaps evolved technical intelligence has some deep tendency to be self-limiting, even self-exterminating. …

I suggest a different, even darker solution to the Paradox. Basically, I think the aliens don’t blow themselves up; they just get addicted to computer games. They forget to send radio signals or colonize space because they’re too busy with runaway consumerism and virtual-reality narcissism. …

The fundamental problem is that an evolved mind must pay attention to indirect cues of biological fitness, rather than tracking fitness itself. This was a key insight of evolutionary psychology in the early 1990s; although evolution favors brains that tend to maximize fitness (as measured by numbers of great-grandkids), no brain has capacity enough to do so under every possible circumstance. … As a result, brains must evolve short-cuts: fitness-promoting tricks, cons, recipes and heuristics that work, on average, under ancestrally normal conditions.

The result is that we don’t seek reproductive success directly; we seek tasty foods that have tended to promote survival, and luscious mates who have tended to produce bright, healthy babies. … Technology is fairly good at controlling external reality to promote real biological fitness, but it’s even better at delivering fake fitness—subjective cues of survival and reproduction without the real-world effects.

Fitness-faking technology tends to evolve much faster than our psychological resistance to it.

… I suspect that a certain period of fitness-faking narcissism is inevitable after any intelligent life evolves. This is the Great Temptation for any technological species—to shape their subjective reality to provide the cues of survival and reproductive success without the substance. Most bright alien species probably go extinct gradually, allocating more time and resources to their pleasures, and less to their children. They eventually die out when the game behind all games—the Game of Life—says “Game Over; you are out of lives and you forgot to reproduce.”

I think the shorter version might be,

The secret of life is honesty and fair dealing… if you can fake that, you’ve got it made. – Attributed to Groucho Marx

The general problem for corporations and countries is that there’s a big problem attributing success to individuals. People rise in power, prestige and wealth by creating the impression of fitness, rather than creating any actual fitness, as long as there are large stocks that separate action and result in time and space and causality remains unclear. That means that there are two paths to oblivion. Miller’s descent into a self-referential virtual reality could be one. More likely, I think, is sinking into a self-deluded reality that erodes key resource stocks, until catastrophe follows – nukes optional.

The antidote for the attribution problem is good predictive modeling. The trouble is, the truth isn’t selling very well. I suspect that’s partly because we have less of it than we typically think. More importantly, though, leaders who succeeded on BS and propaganda are threatened by real predictive power. The ultimate challenge for humanity, then, is to figure out how to make insight about complex systems evolutionarily successful.

The other bathtubs – population

I’ve written quite a bit about bathtub dynamics here. I got the term from “Cloudy Skies” and other work by John Sterman and Linda Booth Sweeney.

We report experiments assessing people’s intuitive understanding of climate change. We presented highly educated graduate students with descriptions of greenhouse warming drawn from the IPCC’s nontechnical reports. Subjects were then asked to identify the likely response to various scenarios for CO2 emissions or concentrations. The tasks require no mathematics, only an understanding of stocks and flows and basic facts about climate change. Overall performance was poor. Subjects often select trajectories that violate conservation of matter. Many believe temperature responds immediately to changes in CO2 emissions or concentrations. Still more believe that stabilizing emissions near current rates would stabilize the climate, when in fact emissions would continue to exceed removal, increasing GHG concentrations and radiative forcing. Such beliefs support wait and see policies, but violate basic laws of physics.

The climate bathtubs are really a chain of stock processes: accumulation of CO2 in the atmosphere, accumulation of heat in the global system, and accumulation of meltwater in the oceans. How we respond to those, i.e. our emissions trajectory, is conditioned by some additional bathtubs: population, capital, and technology. This post is a quick look at the first.

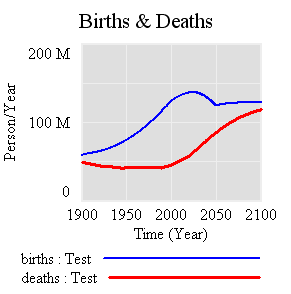

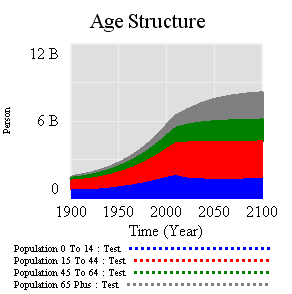

I’ve grabbed the population sector from the World3 model. Regardless of what you think of World3’s economics, there’s not much to complain about in the population sector. It looks like this:

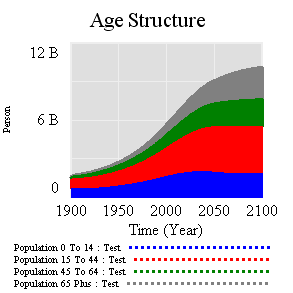

People are categorized into young, reproductive age, working age, and older groups. This 4th order structure doesn’t really capture the low dispersion of the true calendar aging process, but it’s more than enough for understanding the momentum of a population. If you think of the population in aggregate (the sum of the four boxes), it’s a bathtub that fills as long as births exceed deaths. Roughly tuned to history and projections, the bathtub fills until the end of the century, but at a diminishing rate as the gap between births and deaths closes:

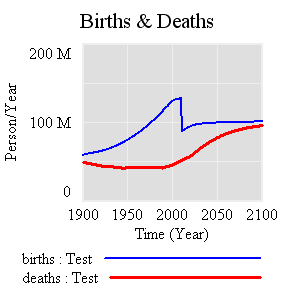

Notice that the young (blue) peak in 2030 or so, long before the older groups come into near-equilibrium. An aging chain like this has a lot of momentum. A simple experiment makes that momentum visible. Suppose that, as of 2010, fertility suddenly falls to slightly below replacement levels, about 2.1 children per couple. (This is implemented by changing the total fertility lookup). That requires a dramatic shift in birth rates:

However, that doesn’t translate to an immediate equilibrium in population. Instead,population still grows to the end of the century, but reaching a lower level. Growth continues because the aging chain is internally out of equilibrium (there’s also a small contribution from ongoing extension of life expectancy, but it’s not important here). Because growth has been ongoing, the demographic pyramid is skewed toward the young. So, while fertility is constant per person of child-bearing age, the population of prospective parents grows for a while as the young grow up, and thus births continue to increase. Also, at the time of the experiment, the elderly population has not reached equilibrium given rising life expectancy and growth down the chain.

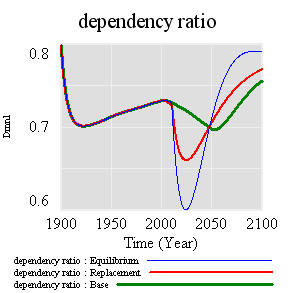

Achieving immediate equilibrium in population would require a much more radical fall in fertility, in order to bring births immediately in line with deaths. Implementing such a change would require shifting yet another bathtub – culture – in a way that seems unlikely to happen quickly. It would also have economic side effects. Often, you hear calls for more population growth, so that there will be more kids to pay social security and care for the elderly. However, that’s not the first effect of accelerated declines in fertility. If you look at the dependency ratio (the ratio of the very young and old to everyone else), the first effect of declining fertility is actually a net benefit (except to the extent that young children are intrinsically valued, or working in sweatshops making fake Gucci wallets):

The bottom line of all this is that, like other bathtubs, it’s hard to change population quickly, partly because of the physics of accumulation of people, and partly because it’s hard to even talk about the culture of fertility (and the economic factors that influence it). Population isn’t likely to contribute much to meeting 2020 emissions targets, but it’s part of the long game. If you want to win the long game, you have to anticipate long delays, which means getting started now.

The model (Vensim binary, text, and published formats): World3 Population.vmf World3-Population.mdl World3 Population.vpm

Hope is not a method

My dad pointed me to this interesting Paul Romer interview on BBC Global Business. The BBC describes Romer as an optimist in a dismal science. I think of Paul Romer as one of the economists who founded the endogenous growth movement, though he’s probably done lots of other interesting things. I personally find the models typically employed in the endogenous growth literature to be silly, because they retain assumptions like perfect foresight (we all know that hard optimal control math is the essence of a theory of behavior, right?). In spite of their faults, those models are a huge leap over earlier work (exogenous technology) and subsequent probing around the edges has sparked a very productive train of thought.

About 20 minutes in, Romer succumbs to the urge to bash the Club of Rome (economists lose their union card if they don’t do this once in a while). His reasoning is part spurious, and part interesting. The spurious part is is blanket condemnation, that simply everything about it was wrong. That’s hard to accept or refute, because it’s not clear if he means Limits to Growth, or the general tenor of the discussion at the time. If he means Limits, he’s making the usual straw man mistake. To be fair, the interviewer does prime him by (incorrectly) summarizing the Club of Rome argument as “running out of raw materials.” But Romer takes the bait, and adds, “… they were saying the problem is we wouldn’t have enough carbon resources, … the problem is we have way too much carbon resources and are going to burn too much of it and damage the environment….” If you read Limits, this was actually one of the central points – you may not know which limit is binding first, but if you dodge one limit, exponential growth will quickly carry you to the next.

Interestingly, Romer’s solution to sustainability challenges arises from a more micro, evolutionary perspective rather than the macro single-agent perspective in most of the growth literature. He argues against top-down control and for structures (like his charter cities) that promote greater diversity and experimentation, in order to facilitate the discovery of new ways of doing things. He also talks a lot about rules as a moderator for technology – for example, that it’s bad to invent a technology that permit greater harvest of a resource, unless you also invent rules that ensure the harvest remains sustainable. I think he and I and the authors of Limits would actually agree on many real-world policy prescriptions.

However, I think Romer’s bottom-up search for solutions to human problems through evolutionary innovation is important but will, in the end, fail in one important way. Evolutionary pressures within cities, countries, or firms will tend to solve short-term, local problems. However, it’s not clear how they’re going to solve problems larger in scale than those entities, or longer in tenure than the agents running them. Consider resource depletion: if you imagine for a moment that there is some optimal depletion path, a country can consume its resources faster or slower than that. Too fast, and they get-rich-quick but have a crisis later. Too slow, and they’re self-deprived now. But there are other options: a country can consume its resources quickly now, build weapons, and seize the resources of the slow countries. Also, rapid extraction in some regions drives down prices, creating an impression of abundance, and discouraging other regions from managing the resource more cautiously. The result may be a race for the bottom, rather than evolution of creative long term solutions. Consider also climate: even large emitters have little incentive to reduce, if only their own damages matter. To align self-interest with mitigation, there has to be some kind of external incentive, either imposed top-down or emerging from some mix of bottom-up cooperation and coercion.

If you propose to solve long term global problems only through diversity, evolution, and innovation, you are in effect hoping that those measures will unleash a torrent of innovation that will solve the big problems coincidentally, or that we’ll stay perpetually ahead in the race between growth and side-effects. That could happen, but as the Dartmouth clinic used to say about contraception, “hope is not a method.”

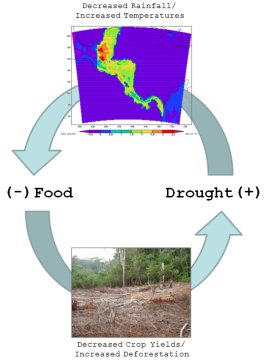

Maya fall to positive feedback

NASA has an interesting article on the fall of the Maya. NASA-sponsored authors used climate models to simulate the effects of deforestation on local conditions. The result: evidence for a positive feedback cycle of lower yields, requiring greater deforestation to increase cultivated area, causing drought and increased temperatures, further lowering yields.

“They did it to themselves,” says veteran archeologist Tom Sever.

…

A major drought occurred about the time the Maya began to disappear. And at the time of their collapse, the Maya had cut down most of the trees across large swaths of the land to clear fields for growing corn to feed their burgeoning population. They also cut trees for firewood and for making building materials.

“They had to burn 20 trees to heat the limestone for making just 1 square meter of the lime plaster they used to build their tremendous temples, reservoirs, and monuments,” explains Sever.

…

“In some of the Maya city-states, mass graves have been found containing groups of skeletons with jade inlays in their teeth – something they reserved for Maya elites – perhaps in this case murdered aristocracy,” [Griffin] speculates.

No single factor brings a civilization to its knees, but the deforestation that helped bring on drought could easily have exacerbated other problems such as civil unrest, war, starvation and disease.

An SD Conference article by Tom Forest fills in some of the blanks on the other problems:

… this paper illustrates how humans can politically intensify resource shortages into universal disaster.

In the current model, the land sector has two variables. One is productivity, which is exhausted by people but regenerates over a period of time. The other… is Available Land. When population exceeds carrying capacity, warfare frequency and intensity increase enough to depopulate land. In the archaeological record this is reflected by the construction of walls around cities and the abandonment of farmlands outside the walls. Some land becomes unsafe to use because of conflict, which then reduces the carrying capacity and intensifies warfare. This is an archetypal death spiral. Land is eventually reoccupied, but more slowly than the abandonment. A population collapse eventually hastens the recovery of productivity, so after the brief but severe collapse growth resumes from a much lower level.

…

The key dynamic is that people do not account for the future impact of their numbers on productivity, and therefore production, when they have children. Nor does death by malnutrition and starvation have an immediate effect. This leads to an overshoot, as in the Limits to Growth, but the policy response is warfare proportionate to the shortfall, which takes more land out of production and worsens the shortfall.

Put another way, in the growth phase people are in a positive-sum game. There is more to go around, more wealth to share, and population increase is unhindered by policy or production. But once the limits are reached, people are in a zero-sum game, or even slightly negative-sum. Rather than share the pain, people turn on each other to increase their personal share of a shrinking pie at the expense of others. The unintended consequence-the fatal irony-is that by doing so, the pie shrinks much faster than it would otherwise. Apocalypse is the result.

Making climate endogenous in Forest’s model would add another positive feedback loop, deepening the trap for a civilization that crosses the line from resource abundance to scarcity and degradation.

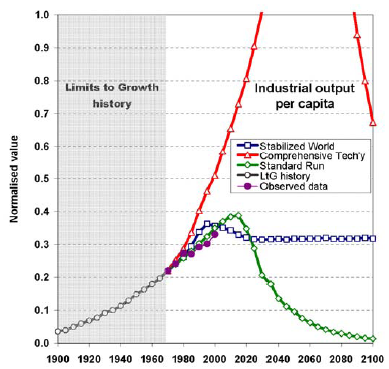

Another Look at Limits to Growth

I was just trying to decide whether I believed what I said recently, that the current economic crisis is difficult to attribute to environmental unsustainability. While I was pondering, I ran across this article by Graham Turner on the LtG wiki entry, which formally compares the original Limits runs to history over the last 30+ years. A sample:

The report basically finds what I’ve argued before: that history does not discredit Limits.

The Growth Bubble

I caught up with my email just after my last post, which questioned the role of the real economy in the current financial crisis. I found this in my inbox, by Thomas Friedman, currently the most-emailed article in the NYT:

Let’s today step out of the normal boundaries of analysis of our economic crisis and ask a radical question: What if the crisis of 2008 represents something much more fundamental than a deep recession? What if it’s telling us that the whole growth model we created over the last 50 years is simply unsustainable economically and ecologically and that 2008 was when we hit the wall ’” when Mother Nature and the market both said: ‘No more.’

Certainly there are some parallels between the housing bubble and environment/growth issues. You have your eternal growth enthusiasts with plausible-sounding theories, cheered on by people in industry who stand to profit.

There’s plenty of speculation about the problem ahead of time:

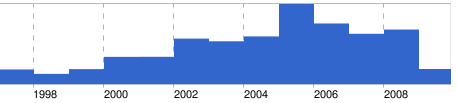

Google news timeline – housing bubble

People in authority doubt that there’s a problem, and envision a soft landing. In any case, nobody does anything about it.

Sound familiar so far?

However, I think it’s a bit of a leap to attribute our current mess to unsustainability in the real economy. For one thing, in hindsight, it’s clear that we weren’t overshooting natural carrying capacity in 1929, so it’s clearly possible to have a depression without an underlying resource problem. For another, we had ridiculously high commodity prices, but not many other direct impacts of environmental catastrophe (other than all the ones that have been slowly worsening for decades). My guess is that environmental overshoot has a lot longer time constant than housing or tech stock markets, both on the way up and the way down, so overshoot will evolve in more gradual and diverse ways at first. I think at best you can say that detecting the role of unsustainable resource management is like the tropical storm attribution problem. There are good theoretical reasons to think that higher sea surface temperatures contribute to tropical storm intensity, but there’s little hope of pinning Katrina on global warming specifically.

Personally, I think it’s possible that EIA is right, and peak oil is a little further down the road. With a little luck, asset prices might stabilize, and we could get another run of growth, at least from the perspective of those who benefit most from globalization. If so, will we learn from this bubble, and take corrective action before the next? I hope so.

I think the most important lesson could be the ending of the housing bubble, as we know it so far. It’s not a soft landing; positive feedbacks have taken over, as with a spark in a dry forest. That seems like a really good reason to step back and think, not just how to save big banks, but how to turn our current situation into a storm of creative destruction that mitigates the bigger one coming.

Will the Chinese Miracle End Soon?

Just after writing my last post on China, I found this remarkably candid SpiegelOnline interview with Pan Yue, China’s Deputy Minister of Environment. A few excerpts:

…

Pan: Of course I am pleased with the success of China’s economy. But at the same time I am worried. We are using too many raw materials to sustain this growth. To produce goods worth $10,000, for example, we need seven times more resources than Japan, nearly six times more than the United States and, perhaps most embarrassing, nearly three times more than India. Things can’t, nor should they be allowed to go on like that.

…

Pan: This miracle will end soon because the environment can no longer keep pace. Acid rain is falling on one third of the Chinese territory, half of the water in our seven largest rivers is completely useless, while one fourth of our citizens does not have access to clean drinking water. One third of the urban population is breathing polluted air, and less than 20 percent of the trash in cities is treated and processed in an environmentally sustainable manner. Finally, five of the ten most polluted cities worldwide are in China.Pan: …Because air and water are polluted, we are losing between 8 and 15 percent of our gross domestic product. And that doesn’t include the costs for health. …

While I was building an electric power model for China in 2005, I saw estimates of 7% GDP losses from health impacts of air pollution, so this strikes me as plausible. One could argue that even 20% of GDP lost to pollution would not be a big deal, because it represents less than three years of growth. But that is to ignore a fundamental valuation problem: that increased material consumption is probably a poor substitute for lost environmental services and especially health problems. In a utopian world where China’s development path reflected individual preferences, are these the choices we would see?

8 to 15 percent is quite a bit more than the 3% in China’s Green GDP accounts, which in any case have been put on hold due to lack of support. On other measures, China’s HDI (a measure of life expectancy, literacy, educational attainment, and GDP per capita) is going up, but its GPI peaked in 2002. The World Bank shows adjustments shaving 16 percentage points off China’s national savings, but the net remains positive. China’s ecological footprint is in deficit territory.

SPIEGEL: But the economic growth fanatics in Beijing will still likely carry on just as before.

Pan: They’re still playing the lead role — for now. For them, the gross domestic product is the only yardstick by which to gauge the government’s performance. But we are also making another mistake: We are convinced that a prospering economy automatically goes hand in hand with political stability. And I think that’s a major blunder. The faster the economy grows, the more quickly we will run the risk of a political crisis if the political reforms cannot keep pace. If the gap between the poor and the rich widens, then regions within China and the society as a whole will become unstable. If our democracy and our legal system lag behind the overall economic development, various groups in the population won’t be able to protect their own interests.

This is crucial. Even communities in the developed world that experience rapid growth go through substantial pain. In part, that’s because growth puts pressure on resources (like open space, freedom from noise and pollution) previously regarded as free, for which property rights or other control mechanisms must be established. If institutions don’t keep up, conflict ensues.

And there’s yet another mistake in this thinking…..

SPIEGEL: Which one?

Pan: It’s the assumption that the economic growth will give us the financial resources to cope with the crises surrounding the environment, raw materials, and population growth.

SPIEGEL: Why can’t that work?

Pan: There won’t be enough money, and we are simply running out of time. Developed countries with a per capita gross national product of $8,000 to $10,000 can afford that, but we cannot. Before we reach $4,000 per person, different crises in all shapes and forms will hit us. Economically we won’t be strong enough to overcome them.

Counting on future growth to solve the problems of past growth is a classic escalation trap – Herman Daly’s “Hair of the Dog that Bit You” from the Catechism of Growth Fallacies in Steady State Economics. Daly cites Wallich, “Growth is a substitute for equality of income. So long as there is growth there is hope, and that makes large income differentials tolerable.” When the growth engine sputters, the social repercussions will be serious.

On Limits to Growth

It’s a good idea to read things you criticize; checking your sources doesn’t hurt either. One of the most frequent targets of uninformed criticism, passed down from teacher to student with nary a reference to the actual text, must be The Limits to Growth. In writing my recent review of Green & Armstrong (2007), I ran across this tidbit:

Complex models (those involving nonlinearities and interactions) harm accuracy because their errors multiply. Ascher (1978), refers to the Club of Rome’s 1972 forecasts where, unaware of the research on forecasting, the developers proudly proclaimed, “in our model about 100,000 relationships are stored in the computer.” (page 999)

Setting aside the erroneous attributions about complexity, I found the statement that the MIT world models contained 100,000 relationships surprising, as both can be diagrammed on a single large page. I looked up electronic copies of World Dynamics and World3, which have 123 and 373 equations respectively. A third or more of those are inconsequential coefficients or switches for policy experiments. So how did Ascher, or Ascher’s source, get to 100,000? Perhaps by multiplying by the number of time steps over the 200 year simulation period – hardly a relevant measure of complexity.

Meadows et al. tried to steer the reader away from focusing on point forecasts. The introduction to the simulation results reads,

Each of these variables is plotted on a different vertical scale. We have deliberately omitted the vertical scales and we have made the horizontal time scale somewhat vague because we want to emphasize the general behavior modes of these computer outputs, not the numerical values, which are only approximately known. (page 123)

Many critics have blithely ignored such admonitions, and other comments to the effect of, “this is a choice, not a forecast” or “more study is needed.” Often, critics don’t even refer to the World3 runs, which are inconvenient in that none reaches overshoot in the 20th century, making it hard to establish that “LTG predicted the end of the world in year XXXX, and it didn’t happen.” Instead, critics choose the year XXXX from a table of resource lifetime indices in the chapter on nonrenewable resources (page 56), which were not forecasts at all. Continue reading “On Limits to Growth”