That’s the title of a post today at The Progressive Economics Forum, introducing a new report from the Canadian Centre for Policy Alternatives.

The bottom line:

In this study, we model the distribution of BC’s carbon tax and recycling measures. Our results conirm that BC’s carbon tax, in and of itself, is regressive. However, the overall carbon tax and recycling framework is modestly progressive in 2008/09 ’” that is, low-income families get back more in credits, on average, than they pay in carbon taxes. If the low-income credit is not expanded, however, the regime will shift to become regressive by 2010/11. It is important for policy makers to rectify this situation in the 2009 and future budgets by minimally ensuring that the credit grows in line with the carbon tax.

A related problem:

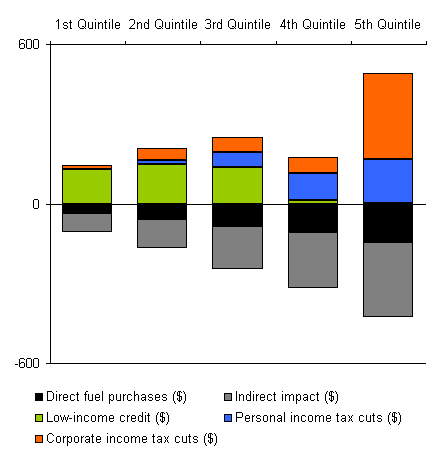

A second concern with the carbon tax regime is that tax cuts undermine a progressive outcome at the top of the income scale. In 2008/09, personal and corporate income tax cuts lead to an average net gain for the top 20% of households that is larger in dollar terms than for the bottom 40%.

I plotted the results in the report’s tables to show some of these effects. In 2009, the lowest income groups (quintiles 1-3) come out a little ahead, but the 4th quintile faces a net loss, while the top income group is overcompensated by the corporate tax cut: