I think it’s a second-best policy, but perhaps the most we can hope for, and better than nothing.

Climate Progress has a first analysis and links to the leaked draft legislation outline and short summary of the Kerry-Lieberman American Power Act. [Update: there’s now a nice summary table.] For me, the bottom line is, what are the emissions and price trajectories, what emissions are covered, and where does the money go?

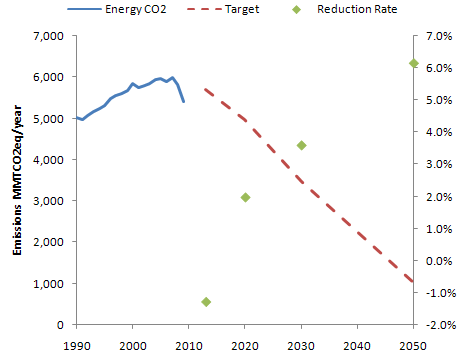

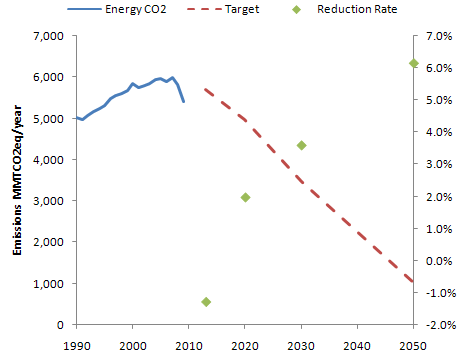

The target is 95.25% of 2005 by 2013, 83% by 2020, 58% by 2030, and 17% by 2050, with six Kyoto gases covered. Entities over 25 MTCO2eq/year are covered. Sector coverage is unclear; the summary refers to “the three major emitting sectors, power plants, heavy industry, and transportation” which is actually a rather incomplete list. Presumably the implication is that a lot of residential, commercial, and manufacturing emissions get picked up upstream, but the mechanics aren’t clear.

The target looks like this [Update: ignoring minor gases]:

This is not much different from ACES or CLEAR, and like them it’s backwards. Emissions reductions are back-loaded. The rate of reduction (green dots) from 2030 to 2050, 6.1%/year, is hardly plausible without massive retrofit or abandonment of existing capital (or negative economic growth). Given that the easiest reductions are likely to be the first, not the last, more aggressive action should be happening up front. (Actually there are a multitude of reasons for front-loading reductions as much as reasonable price stability allows).

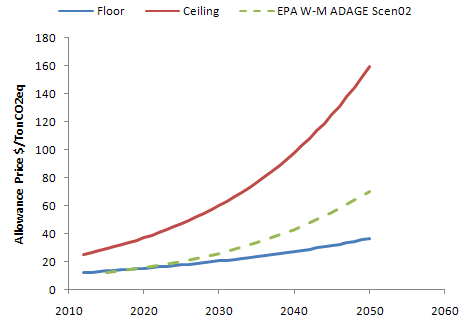

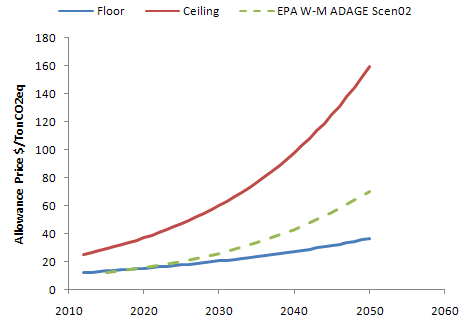

There’s also a price collar:

These mechanisms provide a predictable price corridor, with the expected prices of the EPA Waxman-Markey analysis (dashed green) running right up the middle. The silly strategic reserve is gone. Still, I think this arrangement is backwards, in a different sense from the target. The right way to manage the uncertainty in the long run emissions trajectory needed to stabilize climate without triggering short run economic dislocation is with a mechanism that yields stable prices over the short to medium term, while providing for adaptive adjustment of the long term price trajectory to achieve emissions stability. A cap and trade with no safety valve is essentially the opposite of that: short run volatility with long run rigidity, and therefore a poor choice. The price collar bounds the short term volatility to 2:1 (early) to 4:1 (late) price movements, but it doesn’t do anything to provide for adaptation of the emissions target or price collar if emissions reductions turn out to be unexpectedly hard, easy, important, etc. It’s likely that the target and collar will be regarded as property rights and hard to change later in the game.

I think we should expect the unexpected. My personal guess is that the EPA allowance price estimates are way too low. In that case, we’ll find ourselves stuck on the price ceiling, with targets unmet. 83% reductions in emissions at an emissions price corresponding with under $1/gallon for fuel just strike me as unlikely, unless we’re very lucky technologically. My preference would be an adaptive carbon price, starting at a substantially higher level (high enough to prevent investment in new carbon intensive capital, but not so high initially as to strand those assets – maybe $50/TonCO2). By default, the price should rise at some modest rate, with an explicit adjustment process taking place at longish intervals so that new information can be incorporated. Essentially the goal is to implement feedback control that stabilizes long term climate without short term volatility (as here or here and here).

Some other gut reactions:

Good:

- Clean energy R&D funding.

- Allowance distribution by auction.

- Border adjustments (I can only find these in the summary, not the draft outline).

Bad:

- More subsidies, guarantees and other support for nuclear power plants. Why not let the first round play out first? Is this really a good use of resources or a level playing field?

- Subsidized CCS deployment. There are good reasons for subsidizing R&D, but deployment should be primarily motivated by the economic incentive of the emissions price.

- Other deployment incentives. Let the price do the work!

- Rebates through utilities. There’s good evidence that total bills are more salient to consumers than marginal costs, so this at least partially defeats the price signal. At least it’s temporary (though transient measures have a way of becoming entitlements).

Indifferent:

- Preemption of state cap & trade schemes. Sorry, RGGI, AB32, and WCI. This probably has to happen.

- Green jobs claims. In the long run, employment is controlled by a bunch of negative feedback loops, so it’s not likely to change a lot. The current effects of the housing bust/financial crisis and eventual effects of big twin deficits are likely to overwhelm any climate policy signal. The real issue is how to create wealth without borrowing it from the future (e.g., by filling up the atmospheric bathtub with GHGs) and sustaining vulnerability to oil shocks, and on that score this is a good move.

- State preemption of offshore oil leasing within 75 miles of its shoreline. Is this anything more than an illusion of protection?

- Banking, borrowing and offsets allowed.

Unclear:

- Performance standards for coal plants.

- Transportation efficiency measures.

- Industry rebates to prevent leakage (does this defeat the price signal?).